The U.S. stock market offers incredible opportunities for wealth building, but your success largely depends on choosing the right broker. With over 40 million Americans actively trading stocks, selecting the best trading platform has never been more crucial. Whether you’re a complete beginner taking your first steps in stock investing or an intermediate trader looking to upgrade your tools, the right broker can save you thousands in fees while providing the features you need to succeed.

In 2025, the landscape of stock brokers USA has evolved dramatically. Commission-free trading has become the standard, but the differences between platforms now lie in their tools, research capabilities, user experience, and specialized features. This comprehensive guide will help you navigate the top low commission brokers and find the perfect match for your trading style and experience level.

Why Choosing the Right Stock Broker Matters

Your broker is more than just a platform to buy and sell stocks – it’s your gateway to the financial markets. The wrong choice can cost you money through high fees, missed opportunities due to poor research tools, or frustration from a clunky interface. The right broker, however, can enhance your trading performance through:

- Cost efficiency: Low or zero commissions maximize your returns

- Research tools: Quality analysis helps you make informed decisions

- User experience: Intuitive platforms reduce errors and save time

- Educational resources: Learning materials help you improve your skills

- Customer support: Reliable help when you need it most

What Makes a Great Stock Broker in 2025

Before diving into our top picks, here are the essential features that separate the best trading platforms from the rest:

Commission Structure and Fees

- Zero-commission stock and ETF trades (now standard)

- Competitive options trading fees

- Low margin rates for advanced traders

- Minimal account maintenance fees

Platform Quality and Tools

- User-friendly interface for beginners

- Advanced charting and analysis tools

- Mobile app functionality

- Real-time market data

Investment Options

- Stocks, ETFs, and mutual funds

- Options trading capabilities

- International markets access

- Cryptocurrency trading

Research and Education

- Market analysis and reports

- Stock screeners and research tools

- Educational content and webinars

- Paper trading for practice

Customer Support

- Multiple contact methods (phone, chat, email)

- Extended support hours

- Knowledgeable representatives

- Quick response times

Top Stock Brokers in the USA for 2025

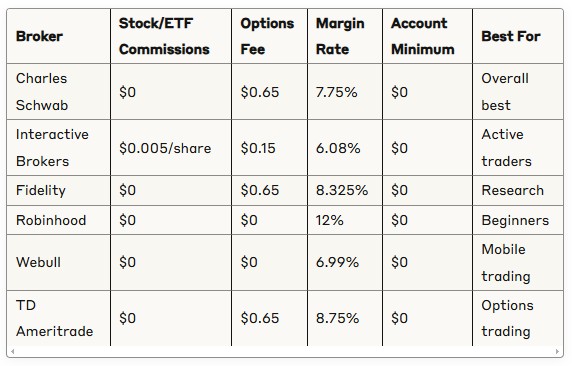

1. Charles Schwab – Best Overall for All Traders

Charles Schwab continues to dominate as the best overall choice for stock brokers USA, offering exceptional value for both beginners and experienced traders.

Key Features:

- $0 commission on stocks and ETFs

- No account minimums

- Excellent customer service (24/7 phone support)

- Comprehensive research tools

- Wide range of investment options

Pros:

- Outstanding customer support

- Robust research and educational resources

- No hidden fees or account minimums

- Strong mobile app

- Fractional share trading available

Cons:

- Options trades cost $0.65 per contract

- Some advanced features require upgrading to thinkorswim

- International trading options are limited

Best for: Long-term investors, beginners who want full-service support, and traders who value customer service

Pricing Overview:

- Stock/ETF trades: $0

- Options: $0.65 per contract

- Margin rates: Starting at 7.75%

- Account minimum: $0

2. Interactive Brokers – Best for Active Traders

Interactive Brokers stands out as the premier choice for active traders and professionals, offering the lowest costs for high-volume trading.

Key Features:

- Lowest margin rates in the industry (starting at 6.08%)

- Advanced trading platforms (Trader Workstation)

- Global market access (150+ markets)

- Professional-grade tools and analytics

Pros:

- Extremely competitive pricing for active traders

- Best-in-class margin rates

- Access to international markets

- Advanced order types and algorithms

- Comprehensive asset classes

Cons:

- Complex interface overwhelming for beginners

- $10 monthly minimum activity fee for accounts under $100,000

- Steep learning curve

Best for: Active traders, day traders, international investors, and professionals

Pricing Overview:

- Stock/ETF trades: $0.005 per share (minimum $1)

- Options: $0.15 per contract

- Margin rates: Starting at 6.08%

- Account minimum: $0 (but $10 monthly fee if under $100,000)

3. Fidelity – Best for Research and Long-Term Investing

Fidelity excels in providing comprehensive research tools and educational resources, making it ideal for investors who want to make informed decisions.

Key Features:

- $0 commission on stocks and ETFs

- Outstanding research and analysis tools

- Active Trader Pro platform for advanced users

- Strong educational resources

- No account minimums

Pros:

- Excellent research capabilities

- No account fees or minimums

- Strong mutual fund selection

- Good customer support

- Active Trader Pro is free

Cons:

- Mobile app could be more intuitive

- Limited cryptocurrency options

- Some advanced features require separate platform

Best for: Research-oriented investors, long-term investors, and those who want comprehensive market analysis

Pricing Overview:

- Stock/ETF trades: $0

- Options: $0.65 per contract

- Margin rates: Starting at 8.325%

- Account minimum: $0

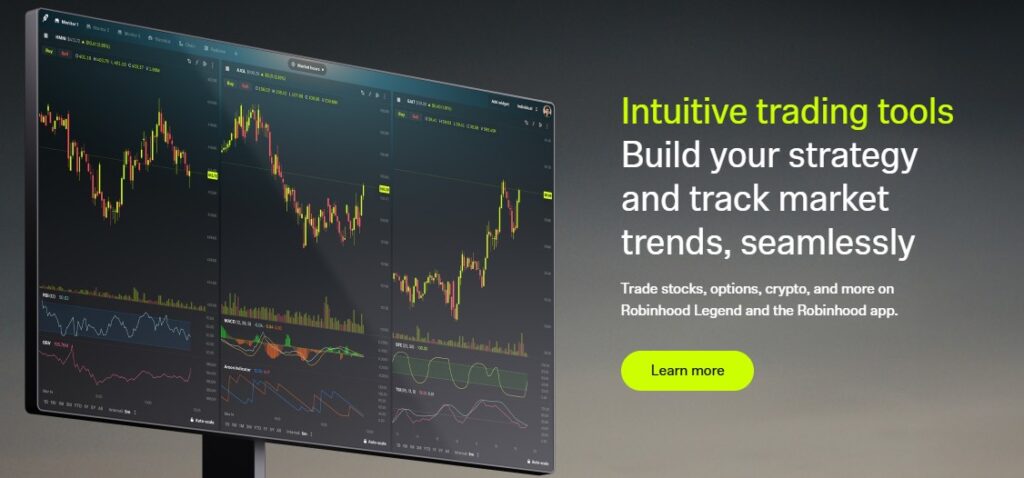

4. Robinhood – Best for Beginners and Mobile Trading

Robinhood revolutionized the industry with commission-free trading and remains the top choice for beginners and mobile-first traders.

Key Features:

- Simple, intuitive mobile app

- $0 commission on stocks and ETFs

- No account minimums

- Fractional shares available

- Cryptocurrency trading

Pros:

- Extremely user-friendly interface

- Great for beginners

- Commission-free trading

- Fractional shares for expensive stocks

- Quick account setup

Cons:

- Limited research tools

- Basic customer support

- No retirement accounts

- Simple platform may lack advanced features

Best for: New investors, mobile-first traders, and casual investors

Pricing Overview:

- Stock/ETF trades: $0

- Options: $0

- Margin rates: Starting at 12%

- Account minimum: $0

5. Webull – Best Mobile Experience for Intermediate Traders

[IMAGE PLACEHOLDER 5] Source: Download the Webull logo from webull.com/about or their press section. Include a screenshot of their mobile app showing the advanced charting features and trading interface. Highlight their technical analysis tools. Ideal size: 800x400px

Webull combines commission-free trading with advanced features, offering a perfect middle ground for growing traders.

Key Features:

- Advanced mobile trading platform

- $0 commission on stocks and ETFs

- Extended trading hours (4 AM – 8 PM ET)

- Good technical analysis tools

- Paper trading feature

Pros:

- Excellent mobile platform

- Extended trading hours

- Good charting tools

- Paper trading for practice

- No account minimums

Cons:

- Customer service primarily through chat/email

- Limited research compared to full-service brokers

- No mutual funds or bonds

Best for: Mobile-first traders, technical analysis enthusiasts, and intermediate traders

Pricing Overview:

- Stock/ETF trades: $0

- Options: $0

- Margin rates: Starting at 6.99%

- Account minimum: $0

6. TD Ameritrade (now part of Schwab) – Best for Options Trading

While being integrated into Schwab, TD Ameritrade’s thinkorswim platform remains a favorite among options traders.

Key Features:

- thinkorswim platform for advanced trading

- $0 commission on stocks and ETFs

- Excellent options trading tools

- Strong educational resources

- Paper trading available

Pros:

- Best options trading platform

- Excellent educational content

- Advanced charting capabilities

- Strong research tools

- Good customer support

Cons:

- Higher options commissions ($0.65 per contract)

- Platform can be overwhelming for beginners

- Being integrated into Schwab

Best for: Options traders, swing traders, and traders who want advanced tools

Pricing Overview:

- Stock/ETF trades: $0

- Options: $0.65 per contract

- Margin rates: Starting at 8.75%

- Account minimum: $0

Comparison Table: Top Stock Brokers USA

How to Choose the Right Broker for Your Needs

For Complete Beginners (Trading for Beginners)

If you’re new to stock investing, prioritize simplicity and education:

Recommended brokers: Robinhood, Charles Schwab, or Fidelity

Key features to look for:

- User-friendly interface

- Educational resources

- Paper trading capabilities

- Good customer support

- No account minimums

Avoid: Complex platforms like Interactive Brokers until you gain experience

For Intermediate Traders

Once you’ve mastered the basics, you’ll want more advanced tools:

Recommended brokers: Charles Schwab, Fidelity, or Webull

Key features to look for:

- Research tools and market analysis

- Advanced charting capabilities

- Options trading capabilities

- Multiple order types

- Reasonable margin rates

For Active Traders

High-volume traders need the lowest costs and best execution:

Recommended brokers: Interactive Brokers or TD Ameritrade

Key features to look for:

- Lowest possible fees

- Advanced trading platforms

- Fast execution speeds

- Professional-grade tools

- Low margin rates

Understanding Fees and Costs

While most brokers now offer commission-free stock and ETF trading, other fees can add up:

Common Fees to Watch

- Options trading: $0.15-$0.65 per contract

- Margin interest: 6%-12% annually

- Account transfer fees: $50-$75

- Wire transfer fees: $15-$25

- Foreign transaction fees: 1-3%

- Inactivity fees: Varies by broker

Hidden Costs

- Payment for order flow: How brokers make money on “free” trades

- Spread costs: Difference between bid and ask prices

- Currency conversion: For international trades

- Data fees: Real-time market data subscriptions

Alternative Trading Solutions: Stock Prop Firms

Many traders are also exploring stock prop firms in 2025 — these companies fund traders, so you can trade with little or no deposit. Prop firms help you get funded to trade remotely, offering an alternative path for skilled traders who want to access more capital without the traditional broker account requirements.

Unlike traditional brokers where you trade with your own money, prop firms evaluate your trading skills and provide funding based on your performance. This means no large deposit needed when trading with a prop firm, making it an attractive option for traders who have the skills but lack the capital to trade at scale.

Getting Started: Step-by-Step Guide

Step 1: Assess Your Needs

- Determine your trading style (long-term vs. active)

- Set your initial investment budget

- Identify your experience level

- List your must-have features

Step 2: Research and Compare

- Use our comparison table above

- Read user reviews and testimonials

- Test demo accounts where available

- Compare total costs, not just commissions

Step 3: Open Your Account

- Gather required documents (ID, Social Security, bank info)

- Complete the online application

- Fund your account via bank transfer or check

- Verify your identity and account details

Step 4: Start Trading

- Begin with small positions

- Use paper trading to practice

- Take advantage of educational resources

- Gradually increase your position sizes

Mobile Trading Apps: The Future of Stock Trading

Mobile trading has become essential for modern investors. Here’s how the top brokers stack up:

Best Mobile Apps

- Robinhood: Simplest interface, perfect for beginners

- Webull: Advanced features with mobile-first design

- Charles Schwab: Comprehensive features with intuitive design

- Fidelity: Strong functionality, slightly complex

- Interactive Brokers: Professional tools, steeper learning curve

Key Mobile Features to Look For

- Real-time quotes and charts

- One-tap trading capabilities

- Portfolio tracking and analysis

- News and research integration

- Biometric security features

Research Tools and Educational Resources

Charles Schwab Research

- Market commentary and analysis

- Stock screeners and research reports

- Educational webinars and courses

- Retirement planning tools

Fidelity Research Excellence

- Comprehensive fundamental analysis

- Technical analysis tools

- Market news and commentary

- Investment planning resources

Interactive Brokers Professional Tools

- Advanced analytics and backtesting

- Real-time market data

- Risk management tools

- Algorithmic trading capabilities

Customer Support Comparison

Phone Support Leaders

- Charles Schwab: 24/7 phone support

- Fidelity: Extended hours with knowledgeable staff

- TD Ameritrade: Good phone support during market hours

Digital Support Options

- Live chat: Most brokers offer real-time chat

- Email support: Standard across all platforms

- Help centers: Comprehensive FAQ sections

- Video tutorials: Step-by-step guidance

Security and Regulation

All recommended brokers are regulated by the Securities and Exchange Commission (SEC) and are members of the Securities Investor Protection Corporation (SIPC), which protects your accounts up to $500,000.

Additional Security Features

- Two-factor authentication

- Biometric login options

- Account monitoring and alerts

- Secure document storage

The Future of Stock Trading

The industry continues to evolve with new technologies and features:

Emerging Trends

- Artificial Intelligence: AI-powered research and trading suggestions

- Social Trading: Following and copying successful traders

- Cryptocurrency Integration: More brokers adding crypto options

- Fractional Shares: Making expensive stocks accessible to all

- Robo-Advisors: Automated portfolio management

Frequently Asked Questions

1. What is the best stock broker for beginners?

For beginners, Charles Schwab and Robinhood are excellent choices. Schwab offers comprehensive support and educational resources, while Robinhood provides the simplest interface for getting started with stock investing.

2. Are there any stock brokers with no fees?

Yes, most major brokers now offer zero-commission trading for stocks and ETFs. However, you may still pay fees for options trading, margin interest, and other services.

3. How much money do I need to start trading stocks?

Most brokers have no minimum account requirements, so you can start with any amount. However, having at least $500-$1,000 gives you more flexibility in building a diversified portfolio.

4. What’s the difference between a broker and a prop firm?

A traditional broker requires you to trade with your own money, while prop firms provide funding for skilled traders. Prop firms help you get funded to trade remotely with their capital after you prove your trading abilities.

5. Can I switch brokers easily?

Yes, most brokers will help you transfer your account from another broker, often covering transfer fees. The process typically takes 5-7 business days.

6. Are my investments safe with online brokers?

Yes, all reputable brokers are SIPC-insured, protecting your accounts up to $500,000. Many also carry additional insurance for further protection.

7. What’s the best broker for options trading?

TD Ameritrade’s thinkorswim platform is widely considered the best for options trading, offering advanced tools and analytics specifically designed for options strategies.

8. Do I need different brokers for different types of trading?

Not necessarily. Most full-service brokers like Charles Schwab and Fidelity can handle various trading styles. However, specialized traders might prefer platforms optimized for their specific needs.

Conclusion

Choosing the right stock broker is a crucial decision that can significantly impact your trading success. Whether you’re a beginner looking for simplicity or an active trader seeking advanced tools, the brokers in this guide offer excellent options for every need and experience level.

Charles Schwab remains our top overall recommendation for its balance of features, support, and value. Interactive Brokers excels for active traders, while Fidelity leads in research capabilities. For beginners, Robinhood offers the simplest entry point into stock investing.

Remember that the best broker for you depends on your specific needs, trading style, and experience level. Take advantage of demo accounts and educational resources to test platforms before committing. Most importantly, focus on building your trading skills and knowledge – the right broker will support your journey, but your success ultimately depends on your decisions and discipline.

Want to start trading without using your own money? Explore the top-rated stock prop firms on StockPropReviews.com.