This The Funded Trader review looks specifically at the consistency rule, because that single rule decides whether most traders ever reach a payout.

On paper, the firm appears beginner-friendly. Low entry cost, flexible time limits, and high advertised profit splits attract a lot of retail forex traders. In practice, the consistency rule quietly filters out a large portion of otherwise profitable traders.

This company is good for traders who make steady, evenly spread profits.It doesn’t work well for traders who need prices to change quickly, news events to happen, or performance to be different all the time. The consistency rule, not the profit goal, is the real test if your plan includes big days every now and then.

Quick Verdict

People often get it wrong, but the Funded Trader doesn’t lie.

Traders who already trade with a set amount of risk and small daily goals can change without too much trouble. Even if their overall strategy is profitable, traders who rely on a few strong sessions to keep their account going usually have a hard time.

The consistency rule is the deciding factor, not the drawdown or the profit split.

What the Consistency Rule Actually Means

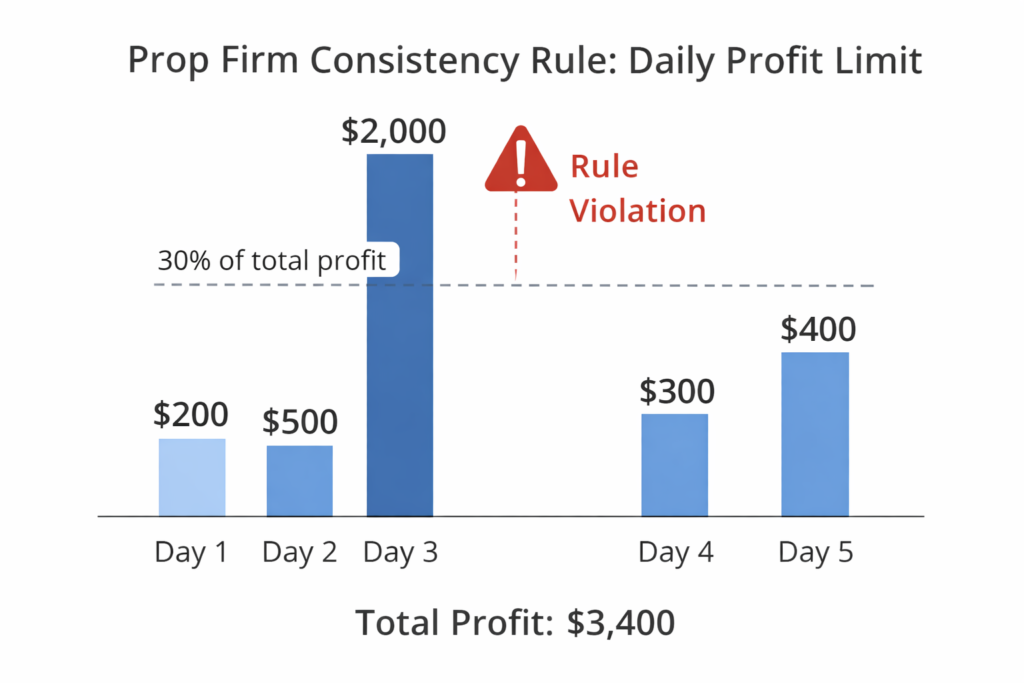

At The Funded Trader, the consistency rule limits how much of your total profit can come from one trading day. In most cases, a single day cannot account for more than roughly 30 percent of your overall gains.

In simple terms, you are not allowed to make most of your money in one session.

This applies during evaluation phases and continues after you become funded. This is true during the evaluation phases and after you get funding. A lot of traders think that the restriction goes away once they get money. No, it doesn’t.

The rule is worked out by a machine. If you cross the line, there is no choice, no appeals, and no room for negotiation.

Why the Rule Exists

The rule makes sense from the company’s point of view.

Prop firms want traders who can manage risk over multiple sessions, not traders who get lucky during a single period of volatility..Even when the trade itself looks clean, big one-day profits often come from higher leverage, more news coverage, or trading based on emotions.

It’s not the rule that is the problem. The issue lies in its interaction with actual trading behaviour.

Where Traders Go Wrong in Practice

Most traders don’t break the consistency rule by betting. They fail because profits tend to group together.

A common situation looks like this. A trader starts an evaluation conservatively and has a strong first or second day. That early profit now represents a large portion of the account’s total gains. From that point forward, the trader must slow down and grind small wins just to dilute that first day.

This creates pressure. Traders either overtrade to rebalance the numbers or avoid good setups because they are afraid of making too much. Both responses damage performance.

Another frequent issue comes from news trading. A single CPI or NFP trade can push the account close to the target, but it also locks the trader into several days of forced low-risk trading to meet consistency requirements.

None of this is explained clearly in most reviews.

Key Rules at The Funded Trader

| Rule | Typical Structure |

| Maximum drawdown | Around 10 percent |

| Daily loss limit | Around 5 percent |

| Profit target | 8 to 10 percent |

| Consistency rule | One day capped at ~30 percent of profit |

| Time limit | Often flexible |

| Profit split | Up to 80 or 90 percent |

Exact conditions depend on account type and can change. Traders should always confirm inside the dashboard before trading.

What Other Reviews Miss

Most competitor articles explain how to calculate consistency. They rarely explain what it feels like to trade under it.

The rule changes trader behavior. Instead of focusing on quality setups, traders start thinking about percentages and distributions. Profitable days become stressful instead of rewarding. A strong session feels like a problem that needs fixing.

This psychological shift is the main reason traders fail, not lack of skill.

Is the Consistency Rule Fair?

From a risk control standpoint, yes.

From a trader’s standpoint, it depends entirely on strategy. Traders with smooth equity curves barely notice the rule. Even if their risk management is good, traders whose edge leads to clustered returns feel limited.

The rule doesn’t tell you how to trade. It decides how your profits are shared.

Strategy Fit

The Funded Trader is best for traders who trade a lot with similar position sizes and small profit goals. Strategies that try to make small, repeatable profits during the day work well.

It doesn’t work well for traders who hold on for bigger moves, scale up quickly, or trade carefully but with purpose. Those strategies can still make money, but they don’t work with strict limits on how much profit can be shared.

People often think that this mismatch means that the trader failed.

Beginner Traders and Expectations

Many new traders choose The Funded Trader because the rules seem easy to follow..Flexible time limits and low entry costs create a sense of safety.

What beginners underestimate is how difficult it is to manage winners. Controlling losses is only half the challenge. Managing profitable days without emotional interference is harder, especially when rules penalize large wins.

For newer traders, simpler rule structures often lead to better learning outcomes.

Comparison With Other Firms

The Funded Trader focuses more on how to share profits and less on how to keep up with time limits than FTMO does. Traders at FTMO feel pressure to keep doing well over time instead of having bad days. This difference is explained in detail in our FTMO review.

Compared to legacy MyForexFunds accounts, The Funded Trader is stricter on profit concentration but often more flexible on timing. The collapse of MyForexFunds showed how loose risk models can create other problems, which we cover in our MyForexFunds truth article.

Alternatives Worth Considering

For traders frustrated by consistency rules, TradeThePool offers a different structure.

It is a regulated stock prop firm that focuses on clear risk limits rather than profit distribution caps. There is no consistency rule restricting how profits are earned, only how risk is controlled.

Readers can get up to 10 percent discount when purchasing through our TradeThePool link. This is not a guarantee of success, but it may suit traders who prefer clarity over flexibility.

Common Mistakes That Cost Traders Accounts

A lot of traders make their bets bigger after winning early, thinking they can slow down later. Some people trade setups that aren’t very good just to make money over the course of several days. Some people stop trading completely after a good session and then rush back when they feel like they have to.

These actions are not bad strategies; they are responses to the rule.

Who Should Avoid The Funded Trader

Traders who depend on news volatility, trades with strong convictions that don’t happen very often, or profits that aren’t evenly distributed should think carefully. If you already have trouble controlling your emotions after winning days, the consistency rule will make that stress worse.

Not working with a company that doesn’t fit your style is a smart move, not a mistake.

Final Thoughts

The Funded Trader is legitimate, but it is not as forgiving as its marketing suggests.

The consistency rule is the true filter. For the right trader, it is a non-issue. For others, it becomes a constant source of friction that no amount of discipline can fully solve.

Choosing a prop firm should start with how you make money, not how attractive the challenge price looks.

FAQs

What is The Funded Trader’s rule about consistency?

It limits how much of your total profit can come from one day of trading, which is usually about 30%.

Can traders reach their profit goal and still lose?

Yes. A lot of traders reach their goals but don’t follow the rules for consistency.

Does the rule still apply after you get money?

Yes. It has an effect on both evaluations and payouts.

Can the consistency rule be changed?

No. It is used in a mechanical way.

Are there prop firms that don’t have rules about consistency?

Yes. Some businesses use different risk models instead.