If you trade CPI, NFP, FOMC, or earnings volatility, you already know what the problem is. Many prop firms say they let you trade news, but your account will still fail as soon as the market becomes volatile. This guide tells you which prop firms really do let you trade news, what that means in real life, and where traders lose their accounts even when the rules seem to be in their favor.

This article is for experienced challenge traders, funded traders, and futures or stock traders who already know how news affects prices. Not for beginners or traders who think news trading will help them pass a challenge faster.

What “news trading allowed” actually means

In the language of prop firms, allowing news trading does not mean that slippage, spread expansion, or execution review will not happen. It just means that the company doesn’t set a fixed blackout window around scheduled economic releases.

Most firms still reserve the right to invalidate or review trades if:

- execution appears unrealistic

- fills occur far outside normal market conditions

- losses breach daily or max drawdown due to volatility

This distinction is where most traders get caught off guard.

Why traders fail even when news trading is allowed

It’s not common for accounts to fail because a company suddenly changes the rules. They don’t work because volatility messes up drawdown models.

A trader puts 1% of their money on CPI. Prices go up, spreads get bigger, and stop losses don’t work. Instead, the trade loses 2.5%. If a company has strict daily loss limits, the account is closed before the trader even knows what happened.

There is no problem with the strategy. There is a problem with the structure.

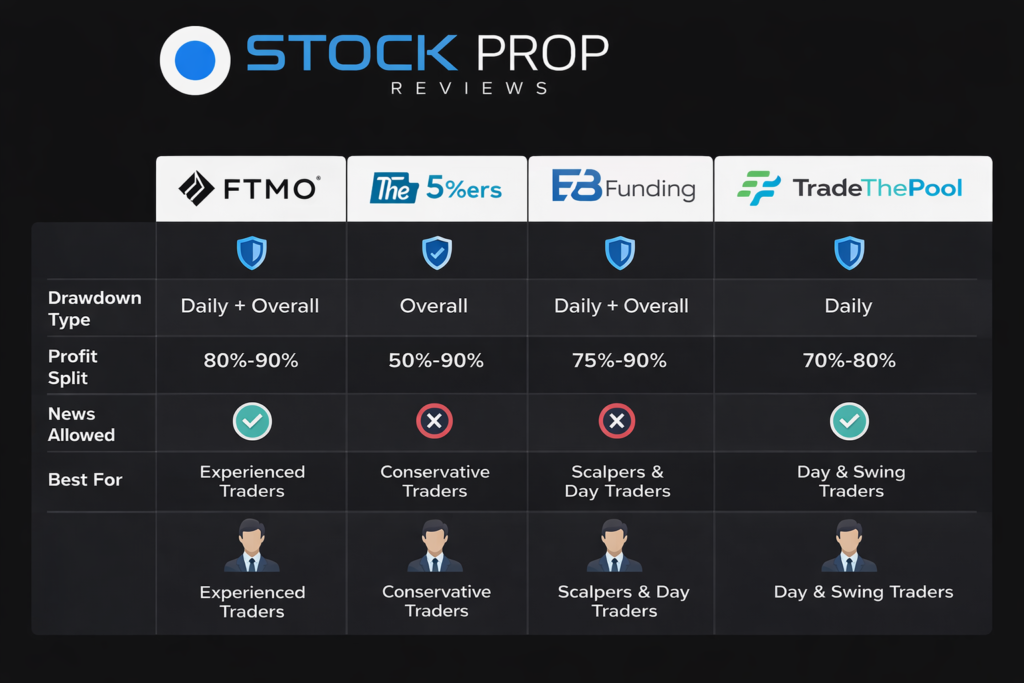

Verified prop firms that allow news trading

These firms explicitly allow news trading in their published rules or have a long track record of permitting it. “Allowed” still comes with caveats.

FTMO news trading review

FTMO allows trading during high impact news releases. There is no fixed time restriction before or after events like NFP or CPI.

In practice, FTMO’s static drawdown model is the bigger issue. Slippage during news can easily cause a daily loss violation even when the trade direction is correct.

FTMO is best suited for traders who already reduce size significantly during news and accept imperfect fills. Traders who rely on tight stops or high leverage tend to fail challenges quickly.

Internal reference: FTMO review and FTMO vs other prop firm comparison.

The 5%ers and news trading

The 5%ers also allows news trading. Their structure is slower, with lower leverage and a growth based model rather than fast challenge passes.

This makes news trading less dangerous, but also less rewarding. Traders expecting large one trade gains from news events are often disappointed.

Where The 5%ers works well is for traders who incorporate news as part of a broader swing or macro bias, not as a standalone event trade.

E8 Funding news rules

E8 Funding allows news trading, but their rules include language around abnormal market conditions and execution discrepancies.

This matters because E8 uses both daily and maximum loss limits. A single slipped trade during news can break the daily limit even if the overall risk plan is conservative.

Traders who treat E8 as a pure news trading firm often struggle. Those who trade reduced size and focus on post release continuation tend to last longer

.

TradeThePool and stock news trading

TradeThePool operates differently from CFD or futures prop firms. It is a regulated stock prop firm, and news trading is allowed on equities, including earnings and macro driven volatility.

The advantage here is rule clarity. There are no artificial spread spikes, and risk is defined by position size and max loss rather than hidden volatility clauses.

Stock news trading still carries gap risk, but traders know exactly where they stand. For traders uncomfortable with CFD execution during news, this structure often feels more predictable.

Readers can get up to 10% discount when purchasing through our TradeThePool link.

Comparison: how news trading fits different drawdown models

It’s not common for accounts to fail because a company suddenly changes the rules. They don’t work because volatility messes up drawdown models.

A trader puts 1% of their money on CPI. Prices go up, spreads get bigger, and stop losses don’t work. Instead, the trade loses 2.5%. If a company has strict daily loss limits, the account is closed before the trader even knows what happened.

There is no problem with the strategy. There is a problem with the structure.

What competitor articles don’t explain

Most competitor guides only list companies and don’t go any further. They don’t often explain how things really work.

When CPI or NFP happens:

- spreads open up right away.

- stop orders turn into market orders.

- fills often happen at the worst possible price.

Demo environments hide this. Live risk shows it.

Another thing that is missing is how traders act. Traders often increase their size after a loss to make up for it. This causes a second breach of the drawdown, not a recovery.

Common mistakes traders make during news

Taking risks with normal size in unusual situations is the most common mistake. News trades shouldn’t be bigger; they should be smaller.

Another mistake is keeping positions open before the release without taking into account how much volatility will increase. Even a correct directional bias can fail because of short-term spikes.

Finally, a lot of traders don’t understand daily loss limits. No matter how long you expect to be in a challenge, one news candle can end it.

Who should avoid news trading at prop firms

News trading is not suitable if:

- You depend on tight stops.

- you think spreads are fixed.

- you’ve never traded live news before.

- you have trouble dealing with quick losses.

You don’t have to trade news to get through challenges. A lot of funded traders never trade at all.

Safer alternatives to news trading

There are better choices if you want volatility:

London and New York session opens after the FOMC trend days, and earnings momentum picks up after the first reaction.

These setups let you move without the chaos of release seconds.

Truth versus marketing

It’s easy to tell the truth. A lot of prop firms let you trade news. Not many traders are ready for it.

Permission does not eliminate risk. It only gets rid of disqualification.

This is why discipline is more important than choosing the right firm during news.

FAQs

Do prop firms really let you trade news?

Yes, a few do. Allowed does not mean that you are safe from slippage or drawdown violations, though.

Is trading news a good way to get past problems?

No, not for most traders. During news, the failure rates are high.

Are futures prop firms better for news?

They usually have cleaner execution, but the risk of volatility still exists.

Is TradeThePool a good place for news traders?

Yes, for stock traders. The rules are clearer, and the execution is more open.

Should new traders buy and sell news?

No. Beginners should stay away from trading news altogether.

Final trader perspective

The weakest part of a trader’s risk model is shown by news trading. If you want to trade news, you can do so with prop firms that let you.

If you trade news, do it less often, expect slippage, and know your drawdown rules better than your entry logic. Trade is a good choice for traders who like clear rules and structures that are regulated.You should think about ThePool. When readers buy through our TradeThePool link, they can save up to 10%.

The market doesn’t care about permission. Just getting ready.