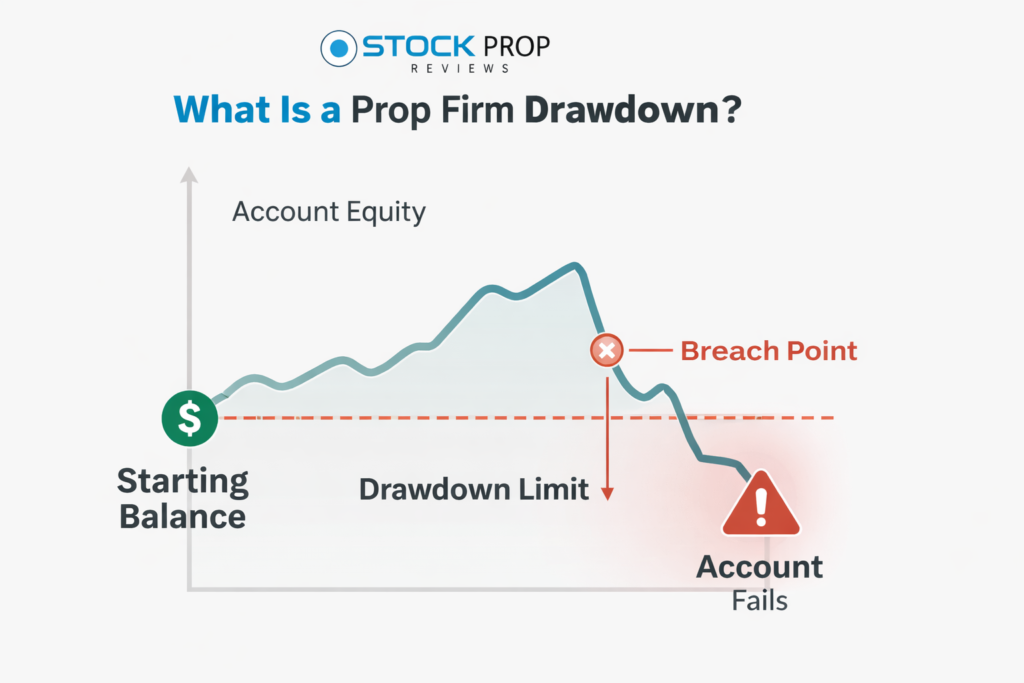

A prop firm drawdown is the most money you can lose before your account is closed and you can’t use it anymore. It is the most important rule in proprietary trading, but it is also the most misunderstood..

This explainer is for beginner and developing prop traders, especially those moving from demo or personal accounts into evaluation challenges or funded accounts. It is not for long-term investors or discretionary swing traders who do not trade under fixed risk rules.

If you misunderstand drawdown mechanics, your strategy can be profitable on paper and still fail every prop firm challenge you attempt. That is why most trader failures have nothing to do with win rate and everything to do with how drawdown is calculated and enforced.

Definition of a Prop Firm Drawdown

A prop firm drawdown is the maximum allowable decline in account equity or balance, defined by the firm’s rules. Once breached, the account is terminated regardless of open trades, prior profits, or long-term expectancy.

There are two dominant types of prop firm drawdown:

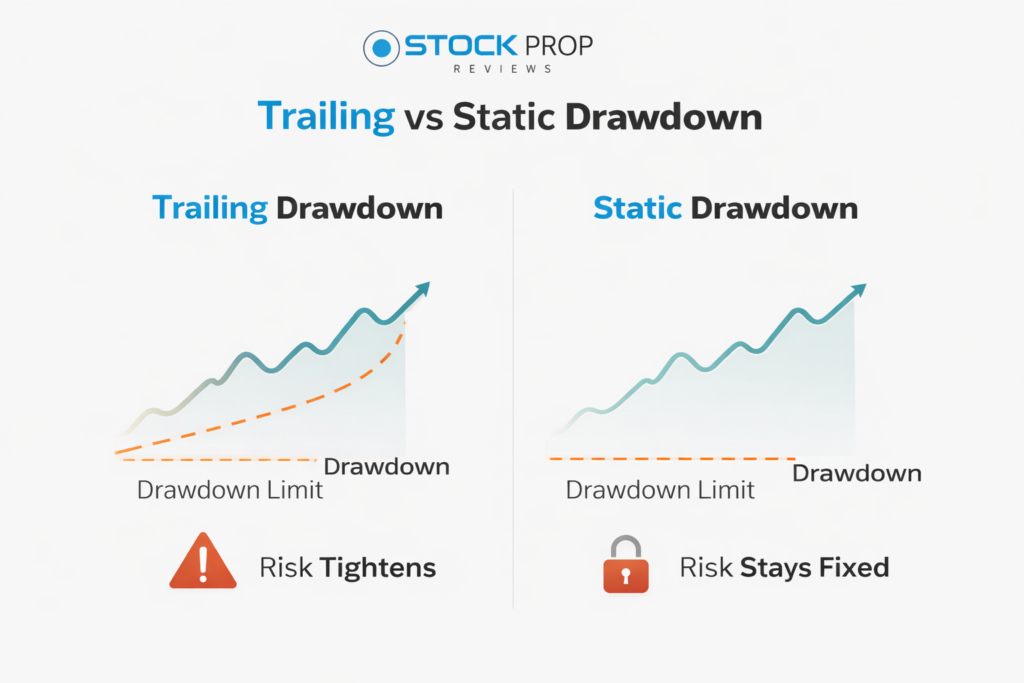

- Trailing drawdown, which moves upward as your account reaches new highs

- Static drawdown, which stays fixed at a defined level

Both look similar in marketing material. In real trading, they behave very differently.

Why Drawdown Rules Matter More Than Profit Targets

Most traders focus on profit targets and ignore drawdown mechanics. That is backwards.

In real trading scenarios, traders rarely fail because they cannot make money. They fail because:

- One large loss violates a daily or overall drawdown

- Profits raise the trailing drawdown, tightening risk

- A normal losing streak becomes account-ending due to rule structure

A strategy that works well in a personal account can collapse under prop firm drawdown constraints without any change in edge.

What Is a Trailing Drawdown in a Prop Firm?

As your account balance or equity reaches new highs, the trailing drawdown goes up. The drawdown level is below your best performance, which lowers the buffer between your account and a violation.

How Trailing Drawdown Works in Practice

Example:

- Starting account: $100,000

- Trailing drawdown: $5,000

- Initial max loss level: $95,000

Your account will have $103,000 if you make $3,000. The trailing drawdown is now $98,000. Your total loss buffer has not grown. It has just moved up.

This means:

- Profits do not give you more room to lose

- Every new equity high tightens your risk tolerance

- Volatility becomes more dangerous as you scale up

Some firms trail on equity, others on balance, and some stop trailing once you reach a specific profit threshold. Those details matter more than the headline number.

What Is a Static Drawdown in a Prop Firm?

A static drawdown stays the same no matter how much money you make.

Example:

- Starting account: $100,000

- Static drawdown: $5,000

- Max loss level stays at $95,000 permanently

You still can’t go below $95,000, but your effective risk buffer has grown to $15,000 if you grow the account to $110,000.

Static drawdowns act more like traditional risk limits and are usually easier for traders to deal with mentally.

Trailing vs Static Drawdown Comparison Table

| Feature | Trailing Drawdown | Static Drawdown |

| Moves with profits | Yes | No |

| Risk tightens over time | Yes | No |

| Forgives volatility | Low | Higher |

| Suitable for scaling | Poor | Better |

| Most common failure cause | Equity spike then pullback | One oversized loss |

| Best for | Low variance strategies | Consistent risk-managed trading |

What Competitors Often Fail to Explain

Most competitor articles describe drawdowns technically but avoid explaining how traders actually lose accounts.

Here is what is usually missing.

Trailing Drawdown Punishes Winning Streaks

A lot of traders fail right after their best day. When a strong run happens, the trailing drawdown goes up so high that a normal pullback wipes out the account.

This is not trading based on feelings. It’s maths.

Drawdown pressure is even higher during evaluation phases, where traders are trying to balance profit targets with strict loss limits. Many firms design evaluations so that traders fail on drawdown before strategy expectancy can play out. This is closely tied to how the prop firm evaluation process works, which we’ve explained separately for traders comparing challenge-based models.

Static Drawdown Still Fails Undisciplined Traders

Static drawdowns are less harsh, but they still hurt:

- Too much debt after making money

- Not paying attention to daily loss limits

- Scaling position size faster than the account grows

The difference is that static drawdowns give traders time to fix their mistakes. Trailing drawdowns don’t always.

Drawdown Type Shapes Strategy Viability

Scalping with a high win rate can fail when there is a trailing drawdown because the equity swings are too small. Strategies with lower frequency often do better, even if their expectancies are the same.

Common Trader Mistakes With Prop Firm Drawdown

Most breaches of drawdown happen because of patterns of behaviour that happen over and over again.

The most common ones are growing bigger after making money, thinking that profits reset risk, not understanding equity-based trailing, and using the same strategy at different companies with different rules.

Another common problem is not paying attention to changes in equity during the day. A trade can still end an account even if it closes in the green if there is an unrealised drawdown breach.

Real Trading Scenarios Where Drawdown Ends Accounts

A futures scalper makes $2,500 in the first hour, which raises the trailing drawdown. Even though the day ends on a positive note, a $1,200 pullback in the last hour breaks the equity drawdown.

A funded forex trader keeps their position through rollover. A temporary widening of the spread pushes equity below trailing limits, which closes the account even though the price goes back up soon after.

These are not failures on the edge. They break the rules..

Trailing drawdown failures are real, not just in theory. We see this happen a lot in companies that aggressively trail equity, where traders pass evaluations but lose funded accounts quickly. Our FundingPips review is a clear example from the real world. Most traders fail because of drawdown mechanics, not strategy quality.

Strategy Fit Analysis Based on Drawdown Type:

Strategies That Have Trouble with Trailing Drawdown

- Scalping at a high frequency

- Strategies for volatility based on news

- Systems based on Martingale or recovery

- Any method that has big swings in equity during the day

Strategies Better Suited for Static Drawdown

- Fixed R many systems

- Day trading in the swing style

- Less trading with bigger stops

- Futures strategies that strictly limit daily losses

Who Should Avoid Trailing Drawdown Firms

Trailing drawdown firms are a poor fit for:

- New traders learning how to execute

- Traders are aggressively scaling up size

- Anyone who doesn’t want to track real-time equity

- Traders who let their winners change over time

Avoidance has nothing to do with skill level. It has to do with how well the structures fit together.

Alternatives Traders Often Overlook

Some traders assume all prop firms use the same drawdown logic. That is not true.

Certain stock prop firms, such as TradeThePool, use clearer static-style risk rules with transparent max loss and daily limits. TradeThePool operates as a regulated stock prop firm, which means drawdown behavior is more predictable than many CFD-based models.

Readers can get up to 10% discount when purchasing through our TradeThePool link.

For futures traders, comparing firms side by side using our TopStep review and Apex Trader Funding review highlights how small drawdown differences lead to very different survival rates.

A broader breakdown is covered in our best prop firms comparison article, which focuses on rule structure rather than marketing claims.

Best For and Worst For Summary

Best For

- Traders who keep a close eye on risk

- Strategies with low variance

- Traders who know how stocks act

Worst for

- emotional scalers

- Traders with high volatility

- Anyone who treats prop firms like their own accounts.

Truth vs Opinion on Prop Firm Drawdown

Truth: The rules for drawdown are meant to protect the company’s capital, not the trader’s comfort.

Truth: Most failures can be predicted and follow a set of rules.

Opinion: Trailing drawdown is better for businesses than for traders.

In my opinion, static drawdowns are more in line with how trading really works.

There is a reason for both models to exist. The error is thinking they can be used interchangeably.

Data, Psychology, and Why Traders Ignore Drawdown

Traders are trained to think about profits, not loss limits. It seems like a background rule until it happens.

Trailing drawdown puts pressure on traders after they have been successful, which makes them trade defensively or hesitate. Static drawdown puts pressure on you after you lose, which makes you more disciplined.

Neither is wrong in and of itself, but they require different ways of thinking.

After getting money, the psychological change can make trailing drawdown harder to deal with than you thought it would be. After making money, traders become defensive, cut back on their positions in an inconsistent way, or wait too long to take advantage of good setups. We look at this pattern in detail in our TopStep review of post-funding failures, which is about companies like TopStep.

FAQs

What happens if I hit a drawdown but then get better?

The account is closed once the limit is reached. Recovery doesn’t matter.

Is trailing drawdown always based on equity?

Not all the time. Some companies only do a trial balance. Always check.

Can I reset drawdown after I pass the test?

Some companies stop trailing after they get money. Some people do not.

Is static drawdown safer?

It is easier to deal with, but you still need to be disciplined.

Why do traders who make money keep failing prop firms?

Because profitability alone doesn’t explain how drawdowns work.

Final Perspective for Traders

You must know what prop firm drawdown is. It decides if your strategy will last long enough to grow.

There is a big difference between trailing and static drawdown rules. It is a structural filter that rewards some styles and gets rid of others.

Before picking a firm, make sure your strategy fits with the drawdown model. That choice is more important than the fees, the profit split, or the promises to grow.

Regulated stock prop firms like TradeThePool offer more transparency than many of their competitors, which is helpful for traders who want clearer risk frameworks. When readers buy through our TradeThePool link, they can save up to 10%.

The goal is not to break the rules. It is to trade with them without any surprises.