This FundingPips review is for traders who want a CFD prop firm that can grow quickly and allows them to trade in various ways, provided they understand how trailing drawdown works in real-life scenarios. FundingPips appears simple on paper, but in practice, it’s not. Most failures don’t come from bad strategies but from misunderstanding equity-based limits and overtrading during strong weeks.

If you already trade with strict risk control and understand how prop firm drawdowns behave during periods of floating profit and loss, FundingPips can be effective. If you rely on aggressive scalping, news spikes, or inconsistent position sizing, it’s one of the easier firms to fail quietly.

Ready to level up your trading journey? Join FundingPips and enjoy fast trading with real-time opportunities to scale.

Who FundingPips is For (and who it isn’t)

FundingPips is suitable for:

- Disciplined CFD traders who know how risky their trades are

- People who have passed at least one prop firm challenge in another place

- Swing and day traders who don’t want to have to deal with permanent floating drawdowns

- Traders are comfortable with trailing equity limits

FundingPips is NOT suitable for:

- Beginners who are new to risk management

- Traders who want revenge or who go too far

- News spike traders who depend on slippage

- Traders who “lock profits late” instead of keeping an eye on equity highs

This difference is important because FundingPips punishes mental mistakes as well as bad analysis.

FundingPips Rules Explained in Layman’s Terms

Most competitor reviews list rules but don’t explain how traders actually violate them.

FundingPips utilizes a trailing drawdown model that adjusts in line with your account equity until a specific threshold is met. This sounds harmless until you realize that unrealized profits can increase your drawdown floor.

Plain-English explanation:

If your account grows, your allowed loss moves up. If you then give back profits too aggressively, you can violate drawdown rules even while still maintaining a positive balance in the account.

This is where most traders fail.

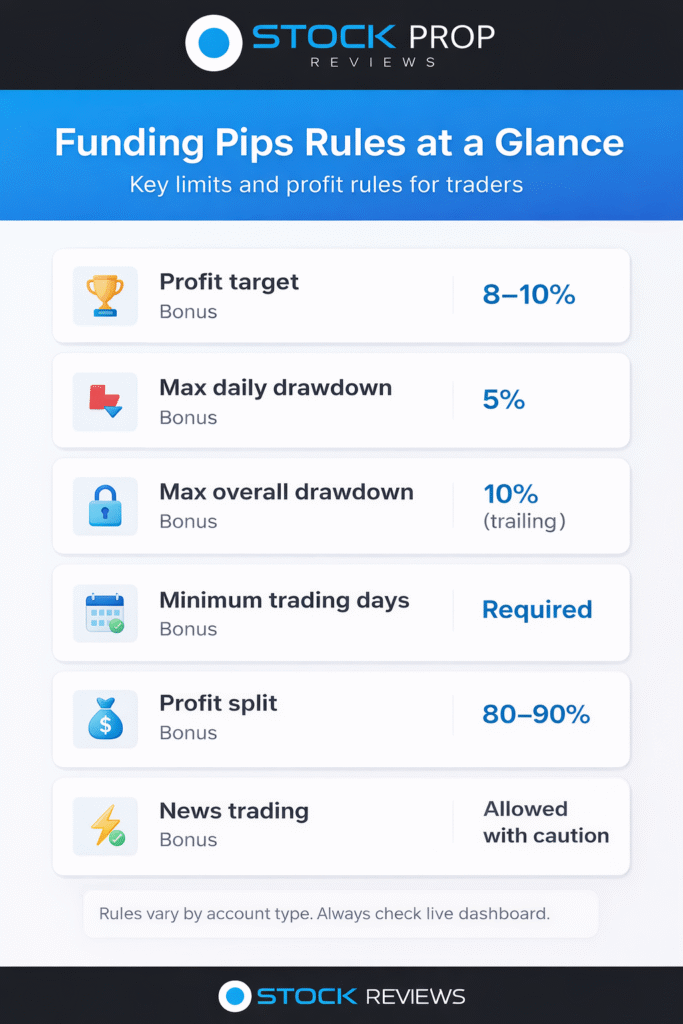

FundingPips Rules Table (Key Limits)

| Rule | Typical Condition |

| Evaluation phases | 1-step or multi-step (varies by account type) |

| Profit target | ~8–10% |

| Max daily drawdown | ~5% (equity-based) |

| Max overall drawdown | ~10% (trailing) |

| Profit split | Up to 80–90% |

| Minimum trading days | Required |

| News trading | Generally allowed (with risk caveats) |

| Weekend holding | Usually allowed |

| Scaling | Performance-based |

Exact figures vary by account type and promotions. Always check the live dashboard.

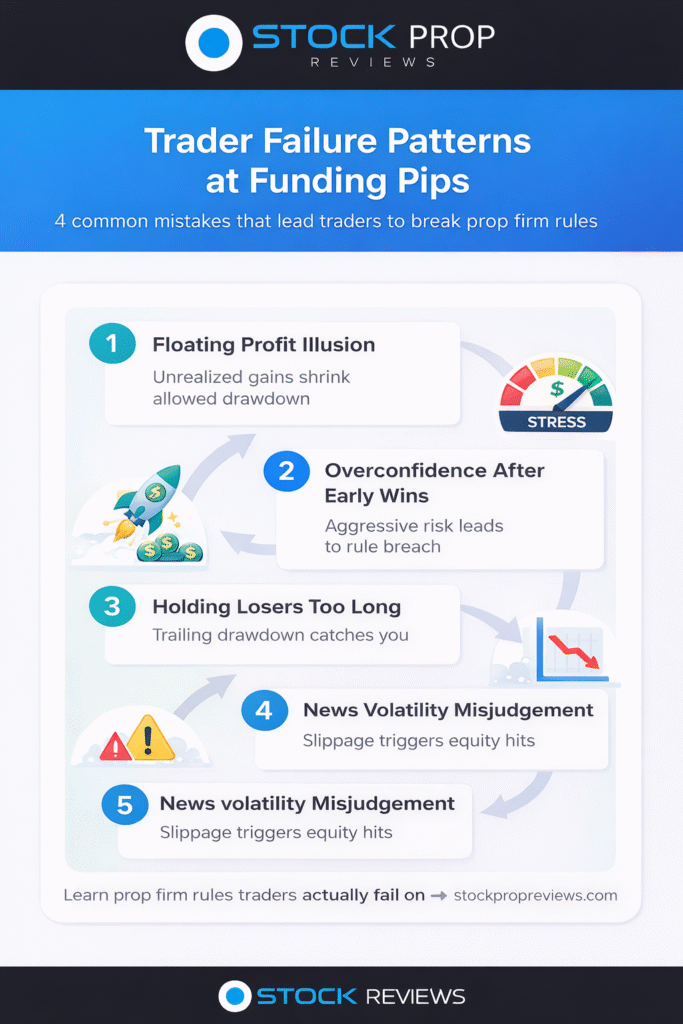

How Traders Actually Fail at FundingPips

These are the real patterns of failure that I found by looking at failed accounts and trader feedback:

1. The illusion of floating profit

Traders make a profit of 4–5% that they don’t realize, feel “safe,” and then let their trades go back. Because the drawdown level follows equity, they unknowingly make their stop threshold tighter.

Result: a violation without ever going red overall.

2. Being too sure of yourself after early wins

FundingPips can seem “easy” in the first week. To get things done faster, traders double their risk, forgetting that trailing drawdowns punish volatility, not just losses.

3. Keeping losers for too long

Swing traders who don’t cut their losing trades short often break drawdown rules before their strategy has had a chance to work.

4. Mistaking news volatility

Even though trading news is technically allowed, slippage and spreads can cause big drops in equity that go over daily limits, even if the direction is right.

What Competitors Don’t Explain About FundingPips

Most reviews focus on:

- Profit split

- Dashboard screenshots

- Payout claims

What they don’t explain:

- How floating equity and trailing drawdown interact

- Why profitable traders fail challenges

- Equity highs cause emotional anguish.

- Why “just close at BE” falls short

FundingPips doesn’t forgive sloppy equity management. The rules are consistent but unforgiving.

Payouts, Proof, and What “on paper” Doesn’t Show

Yes, FundingPips does pay traders. There are screenshots of verified payouts, and there isn’t a lot of evidence that people aren’t getting paid on a regular basis.

But most of the time, the success of a payout is linked to:

- Low risk (less than 0.5% per trade)

- Not many trades happen

- Avoiding spikes in equity

Traders who barely get through challenges often have a hard time doing well again when they don’t have enough money.

This happens with many prop firms, but FundingPips’ trailing model makes it happen faster.

Strategy Fit Analysis

Scalpers

Possible, but dangerous. When tight stops and wider spreads happen at the same time, drawdown breaches can happen quickly.

Intraday Traders

Best fit. Structured entries, set sessions, and limited exposure are all good ways to do things.

Swing Traders

Results were mixed. Only works if you stick to the drawdown and cut losers early.

News traders

A lot of risk. Allowed in theory but punished in practice because of the volatility of execution.

If you want a clearer framework for which strategies actually survive prop firm rules, see our breakdown of prop firm strategy compatibility in the comparison guide on StockPropReviews.

Psychological Traps Unique to FundingPips

FundingPips exposes one thing clearly: profit protection psychology.

Traders often:

- Stop trading when stocks are at their highest points.

- Fear of losing more money than making money

- Unnecessarily micromanage trades

This leads to:

- Early exits

- Strategy deviation

- Inconsistent performance

FundingPips vs Similar Prop Firms

| Feature | FundingPips | Firm A | Firm B |

| Drawdown type | Trailing equity | Static balance | Hybrid |

| Rule complexity | Medium–High | Low | Medium |

| Beginner-friendly | No | Yes | Moderate |

| Payout reliability | Good | Good | Mixed |

| Strategy flexibility | Moderate | High | Moderate |

FundingPips sits in the middle: not the hardest firm, but less forgiving than static drawdown models.

Best for / Worst for

Best for:

- Traders with proven consistency

- Traders who already understand prop firm mechanics

- Those who are comfortable trading slower and smaller

Worst for:

- “All-in” challenge finishers

- Traders chasing quick payouts

- Anyone still refining discipline

Who should avoid FundingPips entirely

Avoid FundingPips if you:

- Increase the lot size emotionally

- Trade without fixed risk per trade

- Depend on news spikes or grid strategies

- Haven’t passed any prop challenge before

There are easier environments to build discipline first.

Alternatives Worth Considering

Depending on your profile:

- Traders wanting simpler drawdown rules should consider static-balance firms.

- Futures-focused traders may benefit from firms with exchange-based execution.

- Stock traders may prefer regulated environments.

TradeThePool

For equity traders specifically, TradeThePool operates as a regulated stock prop firm with clearly defined risk parameters and transparent rules. It’s structurally different from CFD prop firms like FundingPips and suits traders who prefer US equities over leveraged CFDs.

Readers can receive up to a 10% discount when purchasing through our TradeThePool link; however, it may not be suitable for undisciplined traders or high-frequency gamblers.

Final Perspective

FundingPips is not a scam, nor is it a shortcut, and it is not beginner-friendly—despite marketing that may suggest otherwise. It rewards traders who already act like professionals and exposes those who don’t.

Most failures are not about strategy. They’re about:

- Misunderstanding trailing drawdown

- Emotional risk expansion

- Poor equity protection

If you understand these realities, FundingPips can be a viable option. If not, it will quietly take your fee and teach you an expensive lesson.

FAQs – People Also Ask

Is FundingPips a legitimate or a scam?

FundingPips is a legitimate prop firm with verified payouts. Most issues arise from rule violations, not non-payment.

Does FundingPips use trailing drawdown?

Yes. The drawdown trails equity, which means unrealized profits can tighten your loss limit.

Can beginners pass FundingPips?

Technically, yes, practically rare. Beginners often fail due to a lack of risk discipline.

Is news trading allowed on FundingPips?

Generally, yes, but execution risks make it dangerous under equity-based limits.

What’s the biggest mistake traders make at FundingPips?

Letting winning trades turn into large pullbacks, unknowingly breaching trailing drawdown rules.