One of the most misunderstood parts of prop trading is the FTMO drawdown rules. A lot of traders know the numbers, but not many know how those limits work when trades are going on.

This guide is written for beginners and funded traders who trade responsibly but still feel confused about why accounts fail even when trades look profitable. It is not for traders who rely on wide stops, grid systems, or deep floating drawdowns.

Within the first few days of an FTMO evaluation, most failures happen because of daily drawdown, not bad strategies. Understanding how FTMO drawdown rules work in real market conditions matters more than any entry model.

What FTMO Means by Drawdown

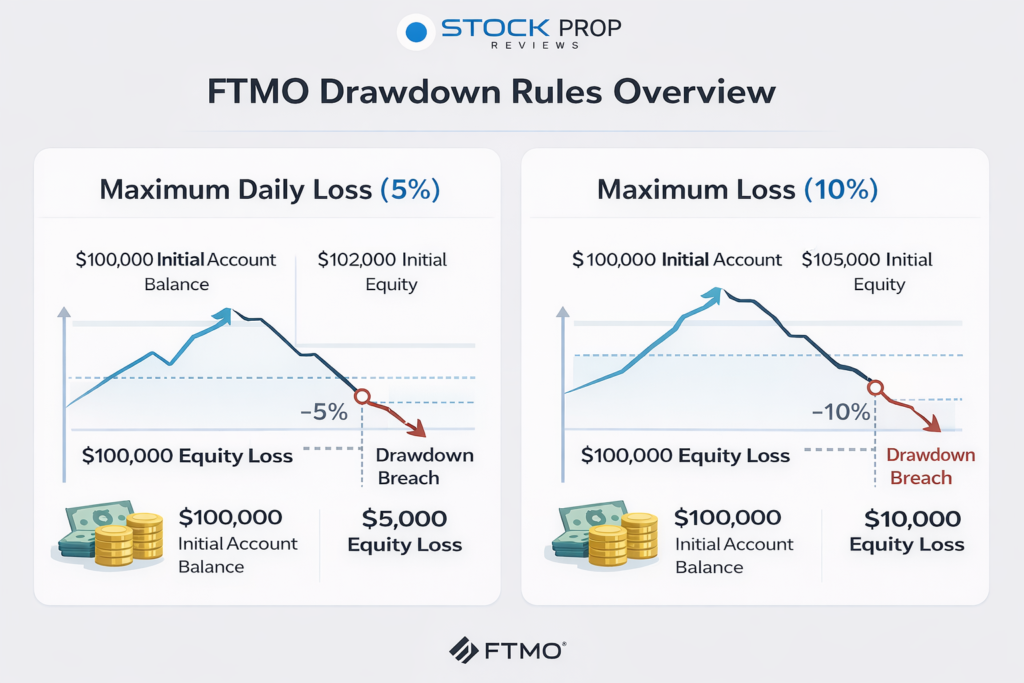

FTMO has two risk limits: the most money you can lose in a day and the most money you can lose overall. Equity, not balance, is used to figure out both. That one thing changes how risk acts all day long.

Equity shows real-time changes in profit and loss. Balance only changes when trades are done. FTMO keeps an eye on equity all the time. If equity hits a limit, the account is instantly broken.

There is no warning and no second chance.

FTMO Drawdown Rules at a Glance

| Rule | FTMO Standard Account |

| Maximum Daily Loss | 5% of initial balance |

| Maximum Loss | 10% of initial balance |

| Measurement | Equity-based |

| Trailing Drawdown | No |

| Reset Time | Daily at server rollover |

| Profit Split | Up to 90% |

On paper, these rules look fair. In practice, equity behaviour catches traders off guard.

How the Daily Drawdown Really Works

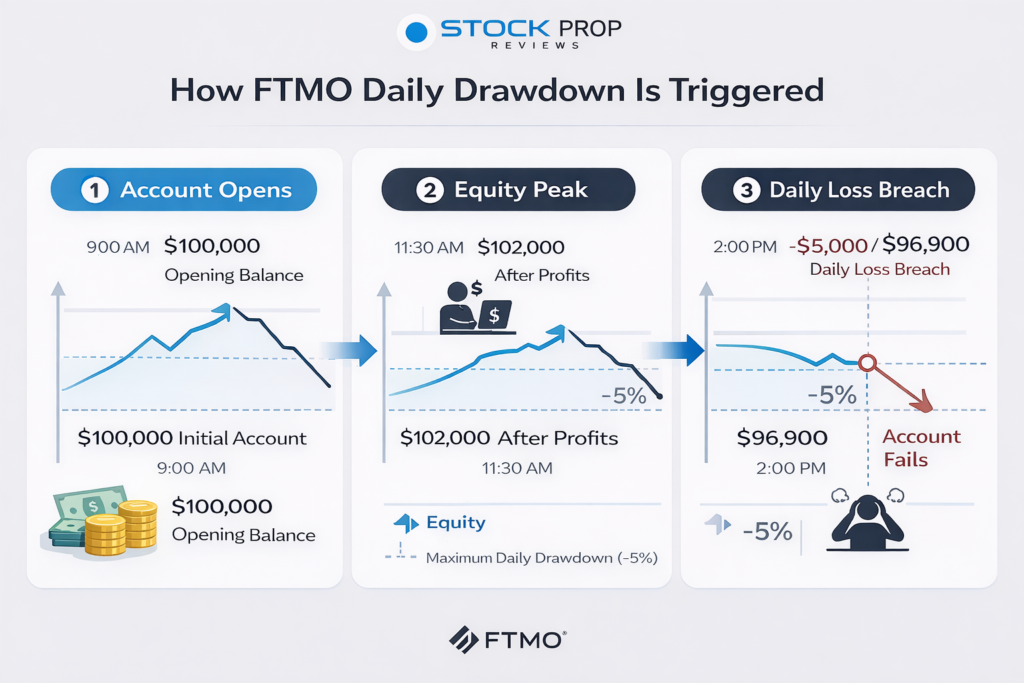

The daily loss limit is calculated from the highest equity point reached during the trading day.

If you trade a $100,000 account, your daily loss limit is $5,000. If your equity rises to $101,800 early in the session, that level becomes the reference point. A drawdown of $5,000 from there fails the account even if your balance is still near breakeven.

Many traders believe daily loss is always measured from the starting balance. It is not. Once equity rises, the room for error shrinks.

A Realistic Trading Example

A trader starts the London session slowly and makes $2,200 by mid-morning. They feel good about it and make it bigger when the New York market opens. A sudden change during a data release sends the floating loss up to $5,300 from the intraday equity high.

The account fails right away.

The trader closes the platform in a hurry because the balance still shows a profit for the day. Equity tells a different story. FTMO uses stocks.

Maximum Loss Rule Explained Simply

The most you can lose is 10% of the amount in your account when you first open it. This limit also keeps an eye on equity.

The maximum loss threshold goes up if your $100,000 account ever has $104,000 in equity. Even if it happens weeks later, a later drawdown to $94,000 breaks the account.

FTMO doesn’t use a trailing drawdown in the usual way, but the highs in equity still affect how much room you have left.

Why Traders Fail Even With Good Strategies

Most FTMO failures are due to behavior, not technology.

Traders often make their positions bigger after they make money early on. Equity peaks make it harder to pull back, and normal pullbacks can suddenly kill you. Some people use mental stops, thinking they can leave on their own. You can’t do that in fast markets.

Scalpers are very easy to trick. Equity can go past its limits before the trade even shows up on screen because of tight margins, widening spreads, and slippage.

FTMO’s rules quickly show weak risk management.

What FTMO’s Own Content Doesn’t Emphasise

FTMO writes educational articles about drawdown, but they don’t often talk about how daily loss limits get tighter when intraday equity highs happen.

They also don’t talk about how hard it is for people to follow equity-based rules when the market is volatile. This pressure is strongest on traders who hedge, scale in, or trade pairs that are linked.

It’s not enough to know the rule; you also have to be able to trade under it.

Who FTMO Is Not Suitable For

FTMO is not a good choice for traders who rely on recovery systems, wide stops, or holding trades through volatile times. It is also not good for traders who get emotionally bigger after winning streaks.

FTMO will feel more like a restriction than a support if your strategy needs to be flexible during drawdowns.

Who FTMO Works Well For

FTMO is a good choice for traders who set a risk level for each trade and stick to it no matter what. Intraday traders who close their positions every day and stay away from news tend to do the best.

Execution discipline is more important than win rate.

FTMO Compared With Other Prop Firms

FTMO’s static drawdown based on equity is different from that of many other companies.

Most Apex accounts use trailing drawdown, which gets tighter quickly after profits. Topstep uses end-of-day drawdown, which many futures traders say is easier for them to handle mentally.

Our FTMO review and Topstep review on StockPropReviews go into more detail about this

.

Drawdown Model Comparison

| Firm | Drawdown Type | Intraday Equity |

| FTMO | Static | Yes |

| Apex | Trailing | Yes |

| Topstep | End-of-day | Limited |

Each model punishes mistakes in a different way. FTMO punishes emotional scaling.

Alternatives Worth Considering

Some traders do better when the rules are different.

TradeThePool is a regulated stock prop firm that has clear rules for losses and risk limits. It’s easier for equity traders to keep track of drawdowns. When you buy through our TradeThePool link, you can save up to 10%.

Futures traders who like to do their calculations at the end of the day might like Topstep. Earn2Trade has a more structured evaluation, but you still have to be very disciplined.

No prop firm does away with the need for risk management.

The Truth About Drawdown Rules

Drawdown rules are not designed to help traders grow accounts. They are designed to protect firm capital.

FTMO’s rules are not unfair, but they are unforgiving. They reward consistency and punish confidence-driven risk increases. This is why many profitable traders still fail evaluations.

We explore this further in our truth article on why prop traders fail despite having edge.

Psychology Matters More Than Math

Most FTMO failures happen during the first week that is profitable or just before a payout attempt. Discipline doesn’t grow as quickly as confidence.

Based on what traders have said and what we’ve talked about in funded account discussions, most breaches happen on volatility days and revenge trades.

The rules stay the same. It does.

Quick Verdict

Traders who are disciplined can handle FTMO drawdown rules, but traders who are emotional will find them very hard to follow. FTMO is fair if you know how equities behave and keep your risk the same. If you focus on setups instead of chasing profits or trade size, you’ll fail quickly.

FAQs

How do you figure out the daily drawdown for FTMO?

It is based on the highest equity that was reached during the trading day.

Does FTMO use a trailing drawdown?

No, but equity highs still make it harder to lose more money.

Why did my account fail even though my balance was good?

Because equity went below the drawdown limit while trades were still open.

Is FTMO more difficult than other prop firms?

It all depends on your plan. Rules based on equity are harder for traders who are aggressive.

Can I keep trades open overnight?

Yes, but floating equity still counts toward drawdown.