Starting your trading journey with a small account in the U.S. can feel overwhelming. Choosing the right broker is one of the most important decisions you’ll make — especially if you’re a beginner or intermediate trader. A broker determines not only how much you pay in commissions and fees but also the tools, platforms, and opportunities you have to grow your account.

For traders with limited capital, every dollar matters. High commissions, expensive data feeds, or inactivity fees can quickly eat into your balance. That’s why finding the best brokers for small accounts in the USA is critical in 2025.

In this guide, we’ll break down the top stock brokers in the U.S., highlight their pros and cons, provide pricing comparisons, and explain why some traders are also looking at prop firms like TradeThePool to trade with funded accounts. Whether you’re interested in day trading, long-term investing, or just learning the ropes, this article will give you a clear path forward.

Why Small Account Traders Need the Right Broker

If you’re trading with less than $1,000–$5,000, the margin for error is thin. Here’s why the right broker matters:

- Low commissions matter – With a small account, even a $5 commission can eat into profits.

- Margin access – Some brokers have minimum requirements for margin accounts.

- Platform usability – Beginners need intuitive apps, while advanced traders may need charting tools.

- No hidden fees – Inactivity fees or account minimums can hurt small traders.

- Fractional shares – Helps new investors buy high-priced stocks like Amazon or Tesla with small amounts.

Best Brokers for Small Accounts USA (2025)

Let’s review the top stock brokers and trading platforms in the U.S. that cater to traders with small accounts.

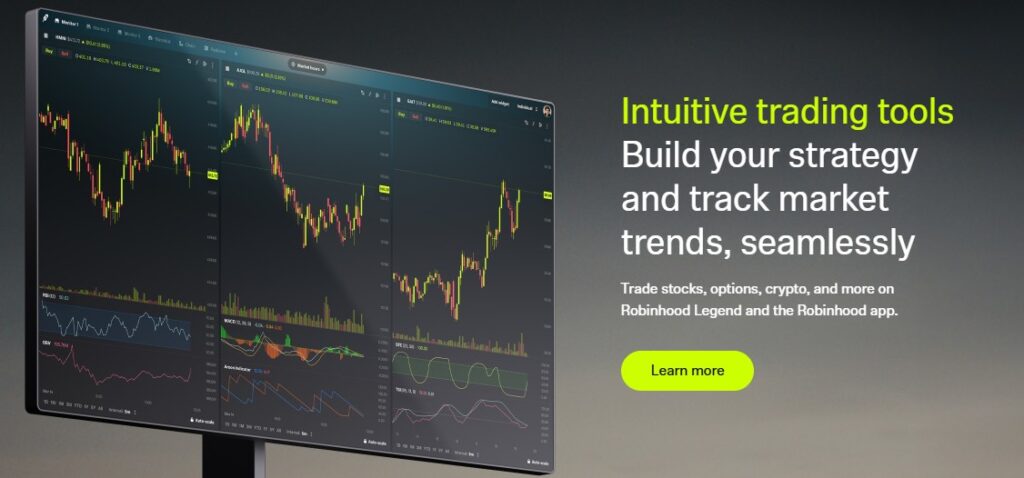

1. Robinhood – Best for Beginners & Zero Commissions

Robinhood popularized commission-free trading and is still a favorite among small account traders.

Key Features:

- $0 stock and ETF trades

- Fractional shares

- Simple, mobile-first platform

- Cryptocurrency trading available

Pros:

- No account minimums

- Easy-to-use interface

- Free stock promotions for new users

Cons:

- Limited research and charting tools

- Not ideal for advanced traders

2. Webull – Best Free Trading Platform with Advanced Charts

Webull combines zero commissions with powerful charting tools, making it a great choice for small accounts looking to grow.

Key Features:

- $0 stock, ETF, and options trades

- Fractional shares available

- Paper trading for practice

- Strong mobile and desktop platforms

Pros:

- Advanced charts & technical tools

- Extended trading hours

- No account minimums

Cons:

- Limited mutual funds or retirement accounts

- Customer support can be slow

3. Fidelity – Best for Long-Term Investors with Small Accounts

Fidelity is one of the largest U.S. brokers, but it’s surprisingly beginner-friendly and perfect for small accounts focused on investing.

Key Features:

- $0 commissions on stocks and ETFs

- Access to fractional shares (“Stocks by the Slice”)

- Strong retirement and mutual fund options

- Excellent research tools

Pros:

- Trusted, regulated broker

- Great for retirement investing

- Excellent customer service

Cons:

- Active traders may find platform less flexible than Webull or TD Ameritrade

4. Charles Schwab – Best All-Around Broker for Small Accounts

Charles Schwab offers a balance between low-cost trading and strong educational resources.

Key Features:

- $0 commissions on U.S. stocks and ETFs

- Schwab Stock Slices (fractional shares)

- Wide selection of accounts (brokerage, retirement, custodial)

- Access to advanced trading platforms (StreetSmart Edge, thinkorswim post-TD acquisition)

Pros:

- Great mix of beginner and advanced tools

- No account minimums

- Excellent customer support

Cons:

- Some platforms may feel overwhelming for new users

5. Moomoo – Best for Active Small Account Traders

Moomoo is a newer broker that’s growing fast in the U.S. because of its zero-commission model and pro-level tools.

Key Features:

- $0 commission stock, ETF, and options trading

- Advanced charting and Level II market data

- Paper trading included

- No account minimums

Pros:

- Great for traders who want advanced features without paying extra

- Strong promotions for new traders

- Supports both beginners and advanced day traders

Cons:

- Less known than big names like Fidelity or Schwab

- Focused mainly on self-directed trading

Broker Comparison Table (2025)

| Broker | Commission | Fractional Shares | Minimum Deposit | Best For |

|---|---|---|---|---|

| Robinhood | $0 | Yes | $0 | Beginners |

| Webull | $0 | Yes | $0 | Active small traders |

| Fidelity | $0 | Yes | $0 | Long-term investors |

| Charles Schwab | $0 | Yes | $0 | All-around choice |

| Moomoo | $0 | Yes | $0 | Pro tools with no cost |

What to Look For in a Broker for Small Accounts

When choosing a broker, especially if you’re starting small, consider these factors:

- Commissions & Fees – Look for $0 trades and no hidden charges.

- Account Minimums – Avoid brokers that require large initial deposits.

- Platform & Tools – Beginners may prefer simplicity, while day traders need advanced charting.

- Fractional Shares – Lets you buy expensive stocks with small amounts.

- Customer Support – Reliable help matters when you’re new.

Prop Firms: A Different Path for Small Account Traders

Even the best U.S. brokers have one challenge: you’re limited by your own capital. That’s where prop trading firms come in.

Prop firms help you get funded to trade remotely — meaning you don’t need to risk your own money. Instead, you trade with the firm’s capital and share profits.

Many traders are also exploring TradeThePool stock prop firm in 2025 — these stock prop firms fund traders, so you can trade with little or no deposit. This is ideal for those who want to skip the PDT rule restrictions (pattern day trading) and grow faster.

👉 Check out tradethepool.com to learn how you can trade without using your own savings.

Pros and Cons of Prop Firms for Small Accounts

Pros:

- No large deposit needed

- Trade with higher buying power

- Keep a percentage of profits

- Skip personal risk of big losses

Cons:

- Evaluation or challenge phases required

- Monthly fees may apply

- Must follow firm’s trading rules

FAQs: Best Brokers for Small Accounts USA

1. Can I start trading with just $100 in the USA?

Yes, brokers like Robinhood, Webull, and Moomoo allow you to start with as little as $0–$100. Fractional shares make it easy to invest in large companies with small amounts.

2. Which broker is best for absolute beginners?

Robinhood is the simplest, but Webull and Fidelity offer better long-term growth features for beginners.

3. What’s the difference between a broker and a prop firm?

A broker lets you trade with your own money, while a prop firm funds you to trade with their capital.

4. Can I day trade with a small account?

Yes, but the PDT (Pattern Day Trader) rule requires $25,000 to day trade freely. Prop firms can be a workaround since they provide funded accounts.

5. Are prop firms legit?

Yes, regulated prop firms like TradeThePool provide real funding opportunities, but traders must pass evaluations.

6. Which broker has the best free tools?

Webull and Moomoo stand out for free charts, Level II data, and paper trading.

7. Do brokers charge hidden fees?

Some brokers may charge for wire transfers, margin interest, or premium data feeds. Always check fee schedules before opening an account.

8. Should I choose a broker or a prop firm?

If you want to invest long-term, go with a traditional broker. If you want to day trade but lack capital, a prop firm like TradeThePool is worth exploring.

Conclusion

Starting with a small account in the U.S. doesn’t have to limit your trading potential. The best brokers for small accounts in 2025 — Robinhood, Webull, Fidelity, Charles Schwab, and Moomoo — all offer zero-commission trading, fractional shares, and no minimum deposits, making them perfect for beginners and small investors.

But if you’re serious about scaling quickly without risking your own savings, consider exploring prop firms like TradeThePool. These firms provide funding, let you trade remotely, and remove the need for large deposits.

👉 Want to start trading without using your own money? Explore the top-rated stock prop firm tradethepool.com.