This Apex Trader Funding review looks past discounts and payout headlines to answer a more important question: can most traders actually sustain withdrawals under Apex’s rules, or does the model quietly work against them?

Apex Trader Funding is one of the most widely used futures prop firms. It appeals to traders because entry costs are low, evaluations are fast, and payouts can come quickly. At the same time, the firm has a high reset rate once traders reach funded status.

Apex is built for futures traders who already understand trailing drawdowns and trade with tight risk control. It is not designed for swing traders, news traders, or anyone who needs flexibility when a trade moves against them.

This review talks about how Apex works in real trading situations, why funded traders lose their accounts, and whether the payout model is good for long-term trading or just short-term withdrawals.

Quick Verdict

Apex Trader Funding is real and open, but its trailing drawdown and payout structure make it hard for most traders to stay in business for a long time. It works best for disciplined futures scalpers who take out small amounts of money often.

What Apex Trader Funding Actually Is

Apex Trader Funding is a futures prop firm that provides simulated funded accounts once traders pass an evaluation. Traders keep a percentage of profits as payouts, while Apex enforces strict risk controls through drawdown rules and account limits.

There is no live capital at risk. Trades are placed in a simulated environment, and payouts are funded by the firm based on performance and rule compliance.

In simple terms, Apex is not paying you to trade freely. It is paying you to trade exactly within a narrow risk box.

Apex Trader Funding Rules

Most traders who fail Apex do not misunderstand the strategy side. They misunderstand the rules.

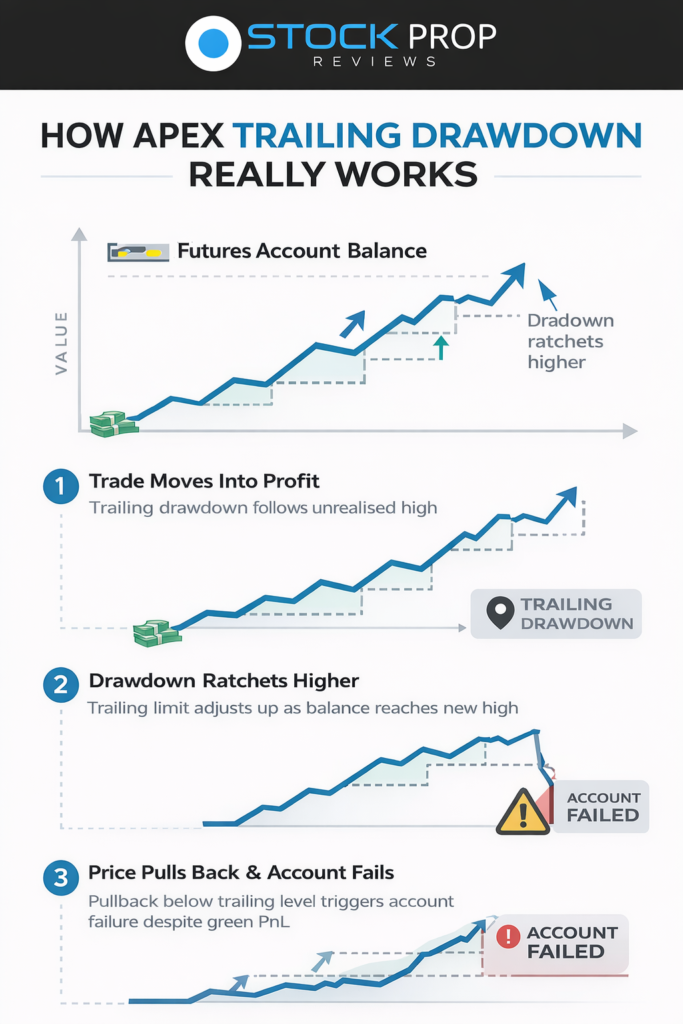

The most important rule is the trailing drawdown. It moves up as your account reaches new highs and never moves back down. This drawdown applies to unrealised profits as well, not just closed trades.

That detail alone explains the majority of failed funded accounts.

Other rules such as minimum trading days and payout thresholds are straightforward, but they add pressure once a trader gets close to withdrawal eligibility.

Trailing Drawdown in Real Trading Conditions

The trailing drawdown is not theoretical. It affects live decisions every day.

A common scenario looks like this. A trader builds solid open profit during a session. The trailing threshold adjusts higher. Price pulls back, stops are hit, and the account violates drawdown even though the trade idea was valid.

This is why Apex heavily favours traders who take quick profits and avoid letting positions breathe. Traders who aim for larger moves often get punished before the move completes.

Many reviews describe this as standard futures risk management. In practice, it is far less forgiving than most traders expect.

Is the Apex Payout Model Sustainable?

This is where Apex needs to be looked at honestly.

Apex looks good on paper because it has quick payouts and good profit splits. In reality, the payout model sets up a trap for behaviour. Once traders are eligible for payout, they often change how they take risks. The size goes up, the patience goes down, and small rule breaks start to happen.

The drawdown doesn’t stop after payouts. It keeps going down, which means that one bad trade can wipe out weeks of careful trading.

Traders who stay in the game for a long time tend to take out small amounts of money over and over again. Traders who go after the biggest payouts usually reset.

The model will only work for traders who know that the account is weak and act accordingly.

What Most Apex Reviews Avoid Saying

A lot of reviews of competitors talk about prices, discounts, and how quickly traders can pass tests. What they don’t talk about very often is how traders leave after getting money.

Apex doesn’t depend on traders having money for years. The structure filters very well. That doesn’t make it wrong, but it does mean that expectations need to be realistic.

Most traders at this firm don’t build long-term equity curves. It is a company where only a small number of people get value, while many others go through evaluations again and again.

Common Reasons Traders Lose Apex Funded Accounts

The most frequent cause of failure is ignoring how unrealised profit affects drawdown. Traders also tend to change behaviour after passing evaluation, often increasing size without adjusting execution quality.

Another issue is trading during volatile periods. Even though news trading is technically allowed, the trailing drawdown makes it extremely risky.

Finally, psychological pressure around payouts leads to mistakes. Traders trade the withdrawal instead of the market

.

Who Should Avoid Apex Trader Funding

Apex is not a good fit for traders who rely on wide stops, hold trades through news, or trade emotionally around milestones. It also does not suit traders who expect drawdowns to be static or forgiving.

If your strategy requires flexibility or patience, Apex will feel restrictive very quickly.

Who Apex Works Best For

Apex is best for futures scalpers who trade contracts that are easy to sell, make quick profits, and limit their exposure during the day. Traders who see their account as short-term capital instead of a long-term portfolio tend to do better.

People who manage a lot of smaller accounts often find it easier to control risk than people who manage one big account.

Apex Compared With Other Futures Prop Firms

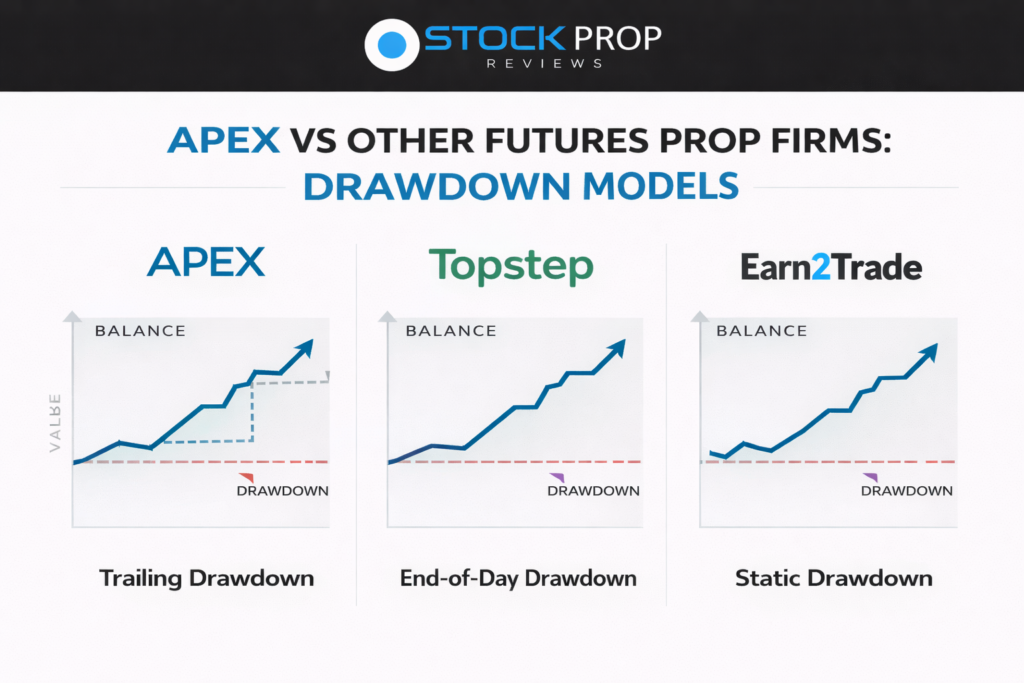

Compared with firms like Topstep and Earn2Trade, Apex is cheaper to enter but harder to sustain.

Topstep and Earn2Trade typically use end-of-day or static drawdowns, which allow trades more room to develop. Apex’s trailing model reacts immediately, which increases pressure but lowers firm risk.

You can see how this difference plays out in our Topstep review and FundingPips review, where drawdown mechanics are compared in detail.

Strategy Fit: Why Some Traders Thrive and Others Fail

Apex rewards consistency but punishes volatility. Strategies with smooth equity curves perform well. High reward-to-risk strategies struggle because unrealised pullbacks matter more than final outcomes.

This mismatch is often misinterpreted as bad luck. In reality, it is structural.

We cover this in more depth in our article on the truth about prop firm drawdowns, which explains why drawdown design shapes trader behaviour.

Data, Psychology, and Survival

Most Apex traders who last longer than a few payout cycles reduce size over time, not increase it. They simplify setups and stop trading for the day once targets are reached.

From a psychological standpoint, Apex forces traders to choose between aggression and survival. Those who choose survival tend to extract value slowly. Those who chase growth usually reset.

A Fair Counter-View

Supporters of Apex are correct about one thing. The rules are visible, and traders are responsible for following them.

Apex does not mislead traders. The issue is not rule clarity but how difficult those rules are to live with over time.

Understanding that difference matters.

Alternatives to Consider

Traders who find Apex too restrictive may prefer firms with static drawdowns and slower payout pressure.

Topstep and Earn2Trade offer more breathing room. For stock traders rather than futures traders, TradeThePool is a regulated stock prop firm with clearly defined loss limits and transparent risk rules.

Readers can get up to 10% discount when purchasing through our TradeThePool link.

TradeThePool suits traders who prefer fixed risk over trailing liquidation logic.

Best For and Worst For

Apex is best for disciplined futures scalpers who trade small amounts, stick to their plans, and only take out small amounts.

Swing traders, news traders, and anyone else who needs to be able to change their mind after a trade is open should not use it.

Final Take

Apex Trader Funding is not a scam, and it is not a way to get money faster. It is a very strict filtering system.

Traders who know this and change their plans can make money. Most of the time, traders who expect breathing room don’t last long.

How much you can handle pressure matters more than your strategy when it comes to Apex.

FAQs

Is Apex Trader Funding legit?

Yes. Apex is a legitimate futures prop firm with clear rules and real payouts.

Why do funded Apex traders lose accounts so often?

Most failures come from trailing drawdown violations during volatile but otherwise profitable trades.

Does Apex pay out reliably?

Payouts are real, but many traders lose funded status before long-term withdrawals accumulate.

Is Apex suitable for beginners?

Only for beginners who trade very small size and focus entirely on rule compliance.

Is Apex better than other futures prop firms?

It is cheaper to enter but harder to sustain than firms with static drawdown.