Many traders who make money never stay funded because of hidden rules at prop firms. This article is for traders who already know how to trade but keep losing money in prop firms. It isn’t for people who are still learning how to control their risks, and it isn’t for traders who want to take shortcuts or get guarantees.

Most prop firms market large profit splits and buying power. What actually decides success is how their rules interact with real trading behavior. Trailing drawdowns, equity-based limits, and forced trading requirements quietly end accounts that would survive in a personal account.

This article breaks down the hidden prop firm rules that kill profitable traders, using real trading situations rather than marketing explanations.

Quick verdict

Most prop traders fail not because they are unskilled, but because the firm’s rule structure conflicts with how they trade.

Trailing drawdowns and equity-based loss limits cause more account failures than bad entries or poor risk management.

What “hidden prop firm rules” really means

Hidden rules are rarely secret. They are usually written somewhere on the site. The problem is how they behave in practice.

A rule becomes “hidden” when:

- Its real impact is not explained clearly

- It behaves differently than traders expect

- It only becomes obvious after an account fails

Most firms explain what a rule is. Very few explain how traders actually break it.

The rule that kills more profitable traders than any other

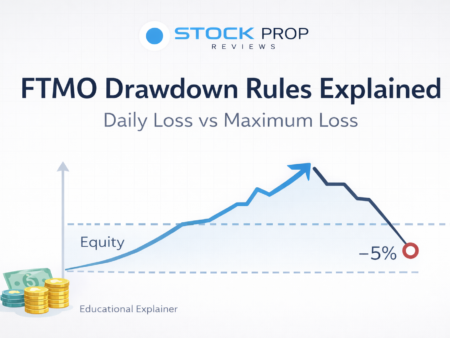

Trailing drawdown based on unrealised profits

Trailing drawdown is responsible for more failed funded accounts than any other rule.

As your account reaches new unrealised highs, the drawdown level moves up. When price pulls back, even briefly, the account can violate the limit despite the trade still being profitable overall.

This is not a rare edge case. It happens during normal market movement.

A trader could have $2,000 in open profit, close the trade at $1,200, and still fail the account because the drawdown stayed close to the high. This is a good trade for me. It can be the end of the line on a prop firm account.

Most of the time, competitors use clear diagrams to explain trailing drawdown. They don’t often talk about how scaling, partial exits, or volatile pullbacks affect it.

Daily loss limits that punish normal sessions

Daily loss limits seem simple until traders see how they work when they reset.

Many companies reset their daily limits at midnight server time instead of at the end of a trading session. Traders who keep their positions overnight or trade during non-US hours can set a new daily loss limit just minutes after the reset.

This catches traders who aren’t careless, but who don’t know what they’re doing.

It also has a bigger effect on traders who trade in more than one session or hold onto runners during times of low liquidity.

Equity-based limits versus balance-based limits

Some businesses figure out drawdown from equity instead of closed balance.

This means that unrealized drawdown counts. Even if the trade later recovers, a short-term pullback during a winning trade can break limits.

This might not matter to scalpers. This is often why accounts fail for day traders and swing traders.

A lot of traders only find out about this difference after they break the rules for the first time.

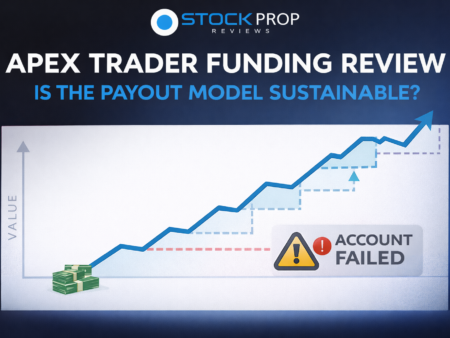

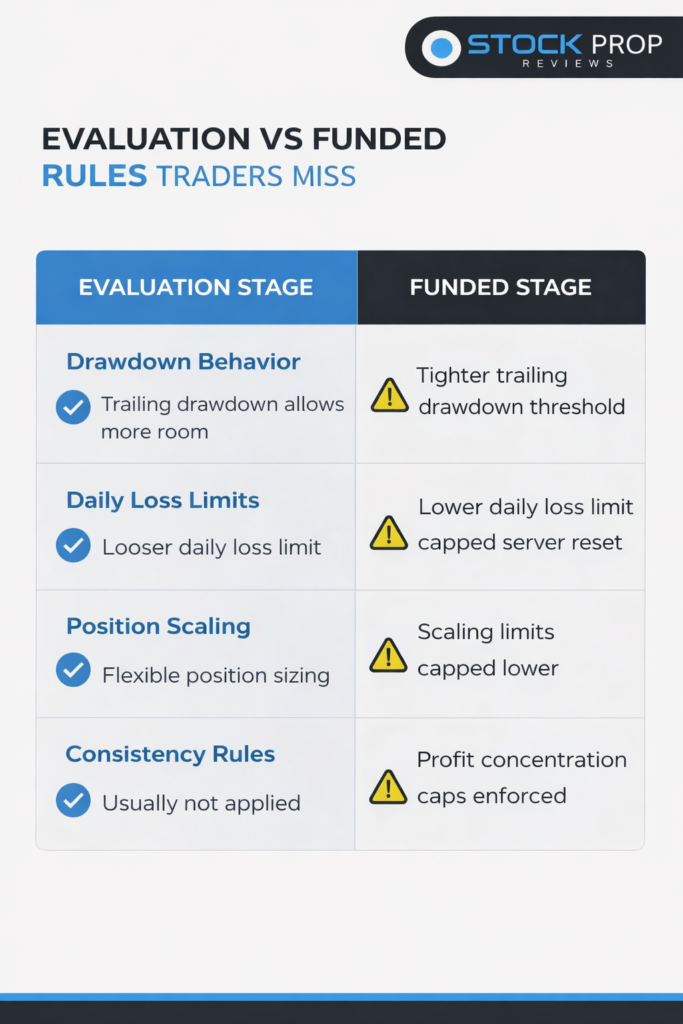

Why traders pass evaluations but fail funded accounts

Just because you pass an evaluation doesn’t mean the funded account works the same way.

Some of the differences are:

- Stricter daily loss limits

- Changed how to figure out drawdowns

- New rules for consistency

- Limits on the size of the scaling position

Competitors often say that evaluation and funded rules are “similar.” In real life, small differences make a big difference.

This is why traders who quickly pass challenges often lose their funded accounts in the first two weeks.

Consistency rules that work against real profitability

Consistency rules limit how much profit can come from a single day or trade.

The idea sounds reasonable. The reality is that good traders often have uneven performance. One strong trend day can make up a large portion of monthly profit.

When a trader has a strong day early, they are forced to trade defensively for weeks. Overtrading and second-guessing usually follow.

These rules do not eliminate risk. They shift it into psychology.

Forced minimum trading days

Minimum trading days encourage activity, not discipline.

A trader who reaches the profit target early must continue trading, often in suboptimal conditions. The pressure to “just survive” leads to unnecessary trades and preventable losses.

This rule benefits the firm far more than the trader.

News trading rules that change after the fact

Many companies say that trading on news is okay, but then they punish traders based on how they interpret it.

Some common grey areas are:

- How close to the release trading is not allowed

- If orders can be placed before news

- Which economic calendar is in use?

When rules aren’t clear and depend on interpretation, the trader takes all the risk.

What competitors usually fail to explain

Most articles about competitors list rules. They don’t explain why people act the way they do.

What is usually not there:

- How partial exits raise the risk of trailing drawdown

- Why it’s risky to let trades run

- How rules affect how people make decisions

- Why traders who make money break the rules by accident

People often talk about failure as a lack of discipline. In fact, it is a mismatch in structure.

Strategy-fit matters more than skill

Scalpers

Scalpers usually stay in business because they don’t take big risks. They work best with drawdowns based on balance and rules that aren’t too strict.

Intraday traders

Daily loss resets and news rules that are easy to understand are important for intraday traders. Being unclear costs money.

Swing traders

Swing traders have the hardest time. Limits based on equity, trailing drawdowns, and overnight exposure are all things that work against them.

Who should avoid most prop firms

Some traders just don’t fit the model.

This includes:

- Traders who have positions open overnight

- Traders who don’t win very often but get a lot of money for their risks

- News traders who don’t have strict rules about when to trade

- Traders who don’t want to change their strategy to follow strict rules

Prop firms give rewards for certain actions. They are not neutral spaces.

Prop firms vs regulated stock prop models

Most CFD and futures prop firms use fake money and strict rules to keep risk low.

Stock prop firms that are regulated work in a different way. They have clearer ways to deal with risk and fewer ways to act badly.

BusinessThePool, for example, is a regulated stock prop firm with clear risk levels and limits on how much money you can lose. The rules aren’t any easier, but they are easier to figure out.

When readers use our TradeThePool link to buy something, they can save up to 10%.

This doesn’t mean you’ll be successful. It shows how clear the structure is.

Comparison snapshot

Traditional prop firms put a lot of emphasis on trailing protection and following the rules. Regulated stock prop models put a lot of focus on clear rules and fixed risk limits.

There is no default better option. Fit is more important than marketing.

The psychological cost of hidden rules

Delayed punishment is the worst thing about hidden prop firm rules.

A trader feels good about their trades, is confident, and is disciplined, but then they lose the account. This makes people confused and doubt themselves, which often leads to revenge trading or giving up on a good strategy.

Clear rules protect both the mind and the money.

Why profitable traders keep repeating the cycle

A lot of traders think the next company will be different.

Most companies, in fact, use different versions of the same structure. Traders make the same mistakes over and over again with different brands because they don’t know how rules affect their strategy.

Simple truth

Prop firm success is not about market skill alone. It is about rule compatibility.

A trader can be profitable and still fail prop firms consistently.

Practical example

A trader trades ES with little risk and moderate hold times. On a personal level, things are going well.

When there is a trailing drawdown on a prop firm account, normal pullbacks go beyond the limits. There was no change to the plan. It was the setting.

Internal reading for context

For firm-specific rule behavior, see our Apex Trader Funding review and the TopStep trader breakdown.

For structure differences, compare prop firm vs personal account trading.

For a deeper opinion-based take, read why profitable traders still fail prop firms.

Final thoughts

Hidden prop firm rules do not eliminate bad traders. They filter out traders who do not adapt to the structure.

Before choosing a firm, test how its rules behave on your worst trading day, not your best.

Traders who want clearer rules should look into regulated stock prop models like TradeThePool. When readers buy through our TradeThePool link, they can save up to 10%.

No guarantees. Just fewer surprises.

FAQs

What are the secret rules of a prop firm?

Rules that are made public but not well explained, which often lead to failures during normal trading.

Why do traders who make money fail prop firms?

Because being profitable and following the rules are two different skills.

Is trailing drawdown always a bad thing?

No. It works for short-term trades but not for long-term holds.

Are prop firms a scam?

Most of them are real businesses. Most failures are caused by structure, not fraud.

Should new traders use prop firms?

Only after you fully understand how the rules work in real life.