This FTMO review answers a question most beginners overlook: what are your real chances of passing, and why do so many traders fail? FTMO is one of the oldest proprietary trading firms. It is known for having strict risk rules, a two-step evaluation, and clear goals. It can work for traders who are disciplined and have shown they can control their risk, but it is not good for beginners who are still trying things out, trading too much, or using aggressive recovery methods.

This review is written from a trader’s perspective, not a marketing one. The goal is to explain the pass rate reality in 2026, who FTMO is actually designed for, and where most traders go wrong.

Quick Verdict on FTMO for Beginners

FTMO is legitimate, structured, and unforgiving. It rewards consistency and patience rather than speed or excitement. Most beginners don’t fail because their strategy is bad. They fail because they don’t understand drawdown rules, they trade emotionally after making money early on, or they treat the challenge like a demo account.

Best suited for:

Traders with a written plan, fixed risk per trade between 0.25% and 0.5%, and experience trading under daily loss limits.

Not suited for:

New traders learning entries, martingale or recovery traders, and scalpers dependent on news spikes or ultra-tight stops.

FTMO Rules Explained in Plain English

Core FTMO Evaluation Rules

| Rule | FTMO Requirement |

| Profit Target Phase 1 | 10% |

| Profit Target Phase 2 | 5% |

| Maximum Daily Loss | 5% |

| Maximum Overall Loss | 10% |

| Minimum Trading Days | 4 |

| Leverage (Forex) | Up to 1:100 |

| Profit Split (Funded) | 80% up to 90% |

What beginners often don’t get is how these rules work in the real world. Daily loss is based on equity, not just balance. Floating losses matter. If you don’t manage a session well, it can ruin a strategy that was otherwise sound.

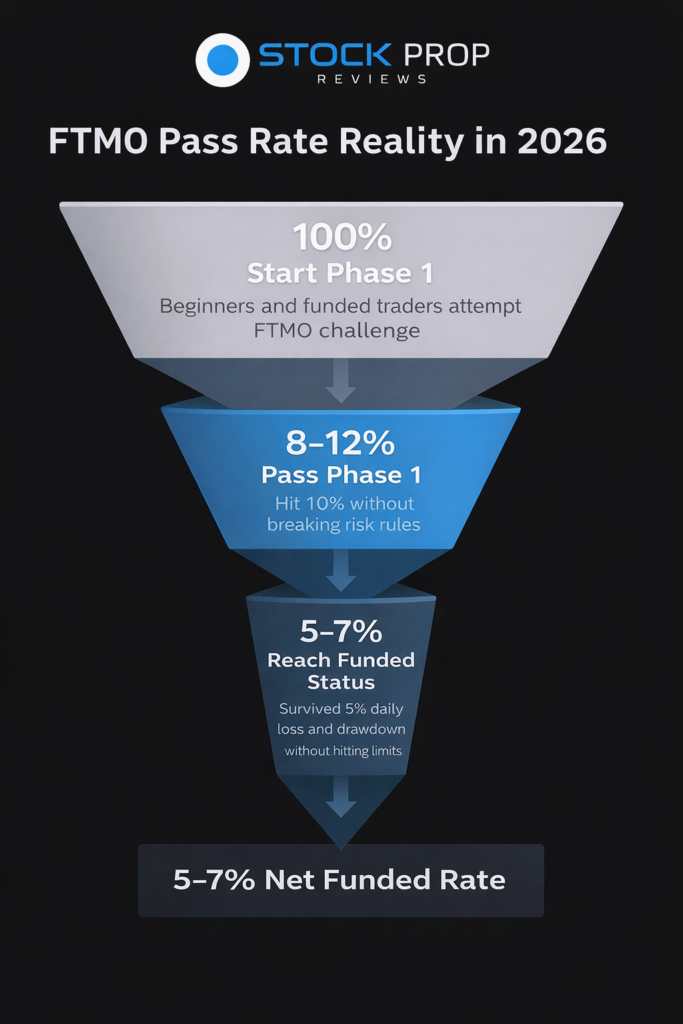

Real FTMO Pass Rate in 2026

FTMO doesn’t make official pass rate data public. Based on what funded traders have said, what prop trading communities have said, and past evaluation statistics, these are what realistic estimates look like: The pass rate for Phase 1 is about 8 to 12 percent. The pass rate for Phase 2 is higher, with about 60 to 70 percent of traders who pass Phase 1. The final funded rate is around 5 to 7 percent. This proves a key point. The problem isn’t getting to the profit goal. The hard part is staying alive while not breaking the rules about risk.

Why Most Traders Fail the FTMO Challenge

The most common failure patterns repeat across thousands of accounts.

Many traders overtrade after early wins. After reaching 2 or 3 percent quickly, they increase position size to finish faster. One pullback breaks the daily loss limit.

Some people don’t get how drawdown math works. Just because you can lose 10% at most doesn’t mean you can risk 2% over and over again. A short losing streak quickly uses up available margin.

Another big problem is revenge trading. Traders who are close to losing money often make one last emotional trade. That trade usually ends the account.

Finally, some strategies simply do not fit FTMO’s rules. News scalping, grid trading, and wide stop swing strategies struggle under equity-based drawdown limits.

What Most FTMO Reviews Do Not Explain

A lot of FTMO reviews that compete with each other talk about platforms, account sizes, and refunds. They don’t often talk about how the evaluation puts psychological pressure on them.

FTMO puts pressure on time, sets strict daily loss limits, and requires a financial commitment through challenge fees. This combination pushes traders to abandon discipline. The rules themselves do not destroy accounts. Trader behaviour does.

What Is FTMO?

FTMO is a prop trading firm that evaluates traders in a simulated environment. Traders must hit profit targets while respecting strict risk rules. Those who pass receive a funded account and keep a share of profits.

During the evaluation, you are not trading real capital. You are proving that you can follow rules under pressure.

Common Beginner Misunderstandings

A lot of beginners think they just need a better plan, but controlling risk is more important than entries. Some people think they will trade less when they are close to their limits, but stress usually makes them make more mistakes. Some assume FTMO is designed to make traders fail, when in reality the rules expose weaknesses that already exist.

Strategy Fit Analysis for FTMO

Strategies that tend to work best include session-based trend continuation during London or New York, low trade frequency, and fixed fractional risk.

Strategies that struggle include high-frequency scalping, trading news spikes, and grid or recovery-based systems.

FTMO vs Other Prop Firms

| Firm | Overall Difficulty | Rule Strictness | Beginner Friendliness |

| FTMO | High | Very strict | Low |

| Funding Pips | Medium | Moderate | Medium |

| MyFundedFX | Medium | Flexible options | Medium |

| TradeThePool | Medium | Clear equity rules | Higher for stock traders |

For traders who prefer equities over forex, TradeThePool stands out as a regulated stock prop firm with clearer risk logic and transparent rules. Readers can get up to 10% discount when purchasing through our TradeThePool link.

Who Should Avoid FTMO

FTMO is not suitable for traders without a journal, traders who change strategies frequently, those who rely on emotional recovery trades, or anyone who has never traded with a hard daily loss cap.

If you regularly break your own stop rules, FTMO will expose that weakness very quickly.

Data, Psychology, and Reality

On paper, a system with a 45 to 50 percent win rate and a 1:2 risk to reward ratio should pass FTMO. In practice, traders sabotage performance by increasing size after wins, skipping stops, or trading outside their planned session.

FTMO does not require brilliance. It requires emotional neutrality, which most beginners have not yet developed.

Alternatives to FTMO Worth Considering

Some traders perform better under different rule structures. Our Funding Pips review explains a more flexible evaluation model. Our FundingPips review covers choice-based rulesets.

For equity traders, our honest TradeThePool review article explains why some traders handle stock prop firm rules better than forex-based evaluations.

Frequently Asked Questions

Is FTMO good for beginners?

Only for beginners who already trade profitably on demo with strict daily loss rules.

How hard is FTMO compared to other prop firms?

FTMO is among the strictest due to equity-based drawdown and daily loss limits.

Can traders really get funded by FTMO?

Yes, but the majority fail before Phase 2 due to rule violations.

Is FTMO legit in 2026?

Yes. It remains one of the longest-running and most transparent prop firms.

What is the biggest mistake new traders make?

Trading the challenge instead of trading their system.

Final Trader Perspective

FTMO does not fail traders. It reveals who is not ready.

If you can trade small, stay consistent, and accept slow progress, FTMO is fair. If you need excitement or constant action, it will feel impossible.

For traders who want clearer risk frameworks, particularly in equities, TradeThePool offers a different approach with transparent rules. Readers can get up to 10% discount when purchasing through our TradeThePool link.

This review exists to help traders avoid costly mistakes and unrealistic expectations, not to sell a challenge.