Why Choosing the Right Broker Matters

Trading and investing have become more accessible than ever, especially for college students in the United States. With zero-commission stock trading, fractional shares, and easy-to-use mobile apps, anyone can start investing with just a few dollars. But here’s the challenge: choosing the right broker matters a lot.

The best brokers for college students in 2025 are those that:

- Have low or no minimum deposits

- Offer commission-free stock and ETF trading

- Provide educational resources for beginners

- Feature mobile apps that are simple yet powerful

- Allow you to grow from small investments to advanced trading

If you’re a student looking to start your journey in the stock market, this guide breaks down the best trading platforms in the USA, compares their features, and gives you real insights into what makes them beginner-friendly.

What College Students Need in a Broker

When picking a stock broker, students usually have three main goals:

- Affordability – Low fees, no account minimums, and fractional shares are a must.

- Ease of Use – A simple app or desktop platform that doesn’t overwhelm beginners.

- Growth Potential – Ability to scale into options, ETFs, or advanced strategies when you’re ready.

Other factors include educational tools, demo accounts, and safety (regulation and SIPC insurance).

Best Brokers for College Students in the USA

Here’s a breakdown of the top brokers in 2025 that work well for students and beginner traders.

1. Robinhood – Best for Simplicity and Commission-Free Trading

Robinhood was one of the first brokers to make commission-free stock and ETF trading the standard in the U.S. Its clean mobile interface makes it ideal for first-time investors.

Key Features:

- $0 account minimum

- Commission-free stocks, ETFs, and options

- Fractional shares (start with as little as $1)

- Easy-to-use mobile app

Pros:

- Simple design, perfect for beginners

- Instant deposit feature for quick trading

- Crypto trading available

- No inactivity fees

Cons:

- Limited research tools

- No mutual funds or retirement accounts

- Not the best for advanced traders

2. Webull – Best for College Students Who Want More Tools

Webull combines commission-free trading with a feature-rich platform. It’s more advanced than Robinhood but still free to use.

Key Features:

- $0 account minimum

- Stocks, ETFs, options, and crypto available

- Extended trading hours

- In-depth charting and analysis tools

Pros:

- Great balance of beginner and advanced tools

- Free stock promos for new users

- Paper trading account (practice with virtual money)

Cons:

- Research tools can be overwhelming for absolute beginners

- Limited educational content

3. Fidelity – Best Long-Term Broker for Students

Fidelity is a traditional broker but one of the best in the USA for young investors. It has fractional shares, zero commissions, and retirement accounts.

Key Features:

- $0 account minimum

- Commission-free U.S. stocks and ETFs

- Fractional shares (Fidelity calls it “Stocks by the Slice”)

- Excellent educational tools

Pros:

- Industry-leading research

- No fees for most accounts

- Great for both beginners and long-term investors

- Offers student-friendly retirement accounts (Roth IRA)

Cons:

- Desktop/web platform can feel more professional than student-friendly

- Fewer crypto options

4. Charles Schwab – Best All-Round Traditional Broker

Charles Schwab is a full-service broker with everything from beginner tools to advanced platforms. It’s great for students who want to start small but plan to grow long-term.

Key Features:

- $0 account minimum

- Commission-free U.S. stocks and ETFs

- Fractional shares via Schwab Stock Slices

- Powerful education resources

Pros:

- Trusted, long-standing broker

- Excellent customer support

- Strong web and mobile platforms

- Long-term investing options like IRAs

Cons:

- Mobile app is less simple compared to Robinhood

- Not ideal if you only want crypto

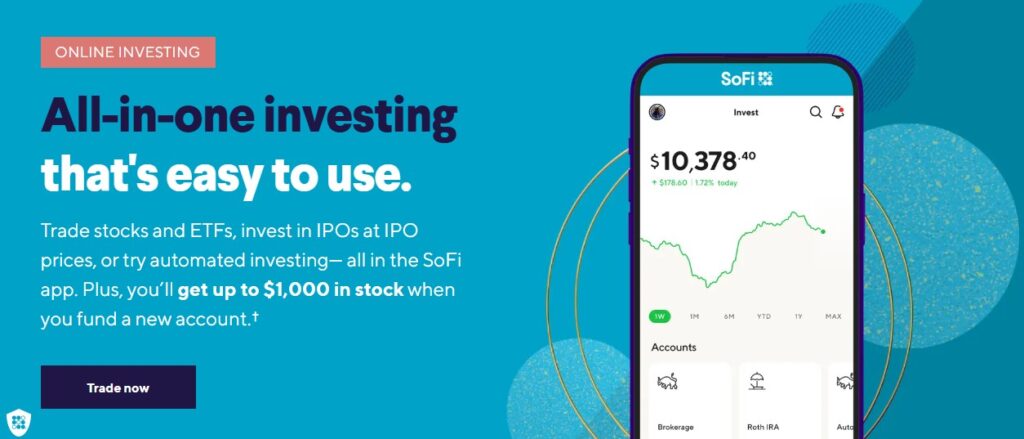

5. SoFi Invest – Best for Beginner Investors Who Want Simplicity + Banking

SoFi Invest is not just a broker — it also integrates personal finance, loans, and banking. For students, that means you can invest and manage money in one app.

Key Features:

- $0 account minimum

- Commission-free stocks and ETFs

- Fractional shares from $5

- Free financial planning

Pros:

- All-in-one money app

- Great for new investors who want a simple setup

- Automated investing (robo-advisor available)

Cons:

- Fewer advanced trading tools

- Limited research

Broker Comparison Table (2025)

| Broker | Min. Deposit | Commission | Assets Available | Best For |

|---|---|---|---|---|

| Robinhood | $0 | $0 | Stocks, ETFs, Options, Crypto | Simplicity, first-time investors |

| Webull | $0 | $0 | Stocks, ETFs, Options, Crypto | Students who want more tools |

| Fidelity | $0 | $0 | Stocks, ETFs, Mutual Funds | Long-term investing + retirement |

| Schwab | $0 | $0 | Stocks, ETFs, Options | Balanced all-round investing |

| SoFi Invest | $0 | $0 | Stocks, ETFs, Crypto | Simplicity + personal finance |

Tips for College Students Before Opening a Brokerage Account

- Start small with fractional shares. Even $5–$10 can get you into the market.

- Avoid risky trades like options until you understand the basics.

- Use demo accounts (like Webull paper trading) to practice.

- Focus on learning rather than short-term profits.

- Pick a platform you’ll actually use — the best broker is the one that fits your lifestyle.

Exploring Prop Firms as an Alternative

Not every college student has the savings to start trading seriously. Even with fractional shares, building a portfolio takes time. That’s why many traders are exploring stock prop firms in 2025.

👉 Prop firms help you get funded to trade remotely. Instead of depositing thousands, you trade with the firm’s capital and share profits.

TradeThePool is one of the leading stock prop firms in 2025. With this model:

- No large deposit needed

- You trade with company funds once you pass an evaluation

- Remote access from anywhere

- Flexible trading styles allowed

Many traders are also exploring TradeThePool stock prop firm in 2025 — these stock prop firms fund traders, so you can trade with little or no deposit.

➡️ Check out tradethepool.com if you want to trade without risking big personal capital.

FAQ: Best Brokers for College Students

1. Do college students need a lot of money to start trading?

No. Many brokers in the USA offer $0 minimum deposits and fractional shares, so you can start with as little as $1–$5.

2. Are Robinhood and Webull safe for students?

Yes, both are SIPC-insured and regulated in the U.S., meaning your funds are protected up to $500,000 (with conditions).

3. Which broker is best for long-term investing?

Fidelity and Schwab are excellent for long-term accounts like IRAs.

4. Can students trade options?

Yes, but it’s risky. Most brokers allow students 18+ to trade options after approval. Beginners should focus on stocks and ETFs first.

5. What about crypto investing for students?

Robinhood, Webull, and SoFi Invest allow crypto trading, but keep allocations small due to volatility.

6. What’s the difference between brokers and prop firms?

- Brokers: You trade with your own money.

- Prop firms: They fund you to trade. No big deposit required, but you share profits.

7. Is TradeThePool good for beginners?

Yes. It’s designed for traders who want to trade stocks without risking their own savings.

Conclusion

For college students in the USA, the best brokers in 2025 are those with low fees, easy apps, and educational resources. Robinhood and Webull are great for beginners, while Fidelity and Schwab provide long-term investing options. SoFi Invest is perfect if you want a simple, all-in-one finance app.

At the same time, prop firms like TradeThePool are changing the game — letting you trade with funding, not your own money.

👉 Want to start trading without using your own money? Explore the top-rated stock prop firm tradethepool.com.